Why might a firm use a combination of methods to calculate the cost of common equity?

Rusty RoboTech, a robotics technology company, has provided the following financial information for the year 20X3:

• Sales Revenue: $500,000

• Net Income: $50,000

• Dividend Payout: 40% of Net Income

• Total Assets at the beginning of 20X3: $300,000

• Total Liabilities at the beginning of 20X3: $150,000

• Equity at the beginning of 20X3: $150,000

• Historical Cash-to-Sales Ratio: 5%

• Accounts Receivable-to-Sales Ratio: 15%

• Inventory-to-Sales Ratio: 25%

• Cost of Goods Sold-to-Sales Ratio: 43%

For the year 20X4, Rusty RoboTech projects a 20% increase in sales revenue. Other ratios and the dividend policy are expected to remain the same.

What is the projected inventory value for Rusty RoboTech at the beginning of 20X4?

What is a primary goal of managing accounts receivable through credit policies?

What distinguishes free cash flow to equity (FCFE) from free cash flow to the firm (FCFF)?

A start-up company's lender is concerned that the company may not be able to meet its financial obligations. It asks the company to provide it with information regarding its current assets and current liabilities.

Which information would the start-up company need to provide to the lender?

What does a beta of less than 1 signify in the capital asset pricing model (CAPM)?

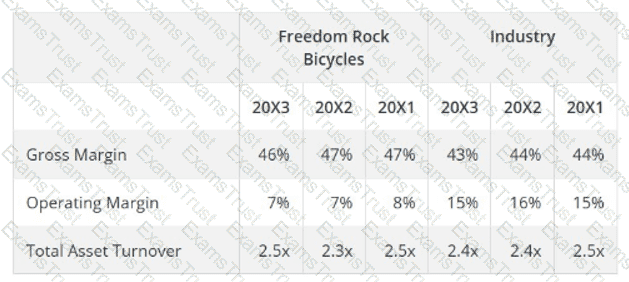

Ratios for Freedom Rock Bicycles are shown below, along with industry average ratios.

What are appropriate recommendations for Freedom Rock Bicycles based on this analysis?

To answer this question, refer to the cash flow worksheet and the internal rate of return (IRR) calculations. The hospital is only interested in accepting projects with an IRR that exceeds 11%. Assuming the hospital has sufficient capital for both projects and is willing to invest for up to 10 years, which project(s) would the hospital accept?

How does asset tangibility affect a company’s capital structure?

A stock has a dividend per share of $5 and is expected to grow at a constant rate of 3% indefinitely. The required rate of return is 9%.

What is the value of the stock?

What is a benefit of a firm extending credit to customers in a competitive market?

In the capital asset pricing model (CAPM), what does a beta (β) greater than 1 signify for a portfolio?

What is a drawback of using the Gordon growth model for estimating the cost of common equity?

Why might tax expense on the income statement not reflect the actual taxes paid by a firm?

How does the global bond market impact the strategies of multinational corporations?

According to the capital asset pricing model (CAPM), how is a stock with a beta of 1.0 expected to perform relative to the market?

A company has a return on assets (ROA) of 10% and total assets of $500 million.

What is its net income?