In a decision strategy, you can use aggregation components to____________.

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on its website to promote new offers to each customer.

Place the events in the sequential order.

A bank has been running traditional marketing campaigns for many years. One such campaign sends an offer email to qualified customers on day one. On day five, the bank presents a similar offer if the first email is ignored.

If you re-implement this requirement by using the always-on outbound customer engagement paradigm, how do you approach this scenario?

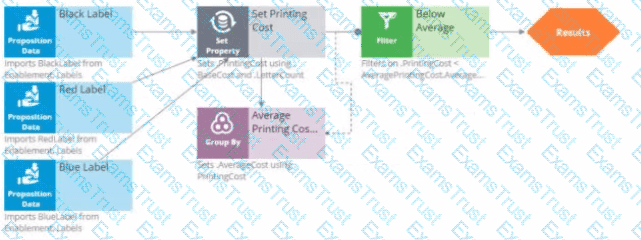

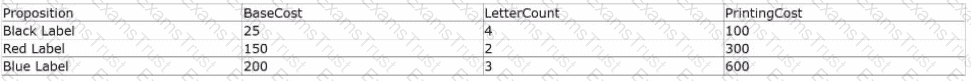

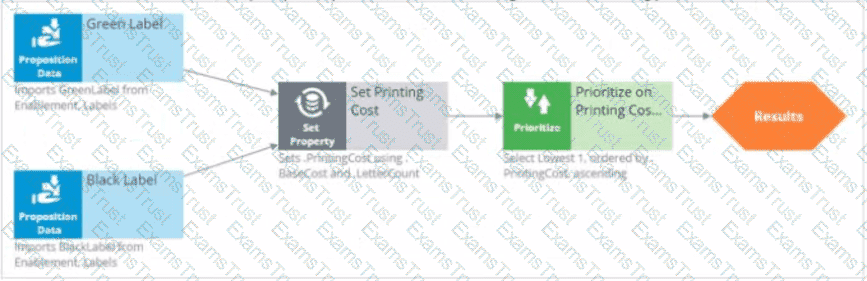

As a decisioning architect, you have built a decision strategy that selects actions that are below the average printing cost. The decision strategy contains 'Black Label', 'Red Label,' and 'Blue Label" Proposition components. The printing cost of the Proposition components are calculated based on the 'BaseCost' and 'LetterCount*.

The details of the proposition components are provided in the following table:

Which propositions does the strategy output?

A financial institution has created a new policy that states the company will not send more than 500 emails per day. Which option allows you to implement the requirement?

A financial institution's NBA team discovers that they need to modify their risk assessment strategy and edit a scorecard used for loan approvals. The team lead reviews the available options in 1:1 Operations Manager to determine the most appropriate approach to implementing these changes.

Which approach should the team lead use to implement these strategy and scorecard modifications?

A financial services company has implemented always-on outbound campaigns for three credit card offers: Standard card. Rewards card, and Rewards Plus card. The marketing team observes that customers who are qualified for multiple actions receive different numbers of offers, depending on the configuration of the volume constraint mode. To optimize customer engagement, the system administrator must choose between constraint modes.

Which volume constraint mode ensures that customers receive all actions for which they qualify, provided the actions do not reach volume limits?

Myco Bank, a retail bank, uses the Customer Engagement Blueprint to design personalized customer journeys. The bank wants to better understand its diverse customer base to create more targeted engagement strategies.

What key achievement does the Personas stage provide for Myco Bank when implementing with Customer Engagement Blueprint?

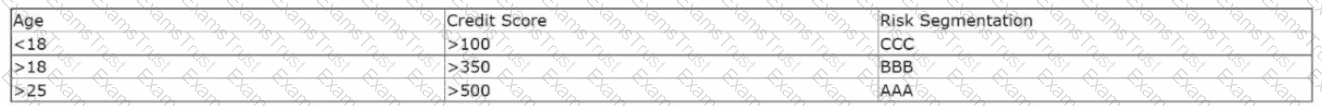

U+ Bank wants to offer credit cards only to customers with a low-risk profile. The customers are divided into various risk segments from AAA to CCC. The risk segmentation rules that the business provides use the Age and the customer Credit Score based on the following table. The bank uses a scorecard model to determine the customer Credit Score.

As a decisioning architect, how do you implement the business requirement?

U+ Bank wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

U+ Bank implemented a customer journey for its customers. The journey consists of three stages. The first stage raises awareness about available products, the second stage presents available offers, and in the last stage, customers can talk to an advisor to get a personalized quote. The bank wants to actively increase offers promotion over time.

What action does the bank need to take to achieve this business requirement?

U+ Bank, a retail bank, has purchased Pega Customer Decision Hub. The bank currently uses an external tool to design email content and a third-party email service provider to send emails to its customers.

As a decisioning architect, how do you recommend the bank implements this requirement?

U+ Bank, a retail bank, has recently implemented Pega Customer Decision Hub. The bank currently uses an external tool to design email content and a third-party email service provider to send emails to its customers.

As a decisioning architect, how do you recommend the bank implements this requirement?

U+ Bank, a retail bank, uses the Business Operations Environment to perform business changes. The team members of the Business Content team and Enterprise Capabilities team perform several roles in the change management process.

Select each role on the left and drag it to the task descriptions to which the role corresponds on the right.

MyCo, a telecom company, uses Pega Customer Decision Hub™ to present offers to qualified customers. The business recently decided to send offer messages through the email channel. The Design department has designed an email treatment which includes dynamic placeholders.

As a deaccessioning architect, what do you use in order to test the visualization and the rendering of the email content, including replacing of the placeholders with customer information?

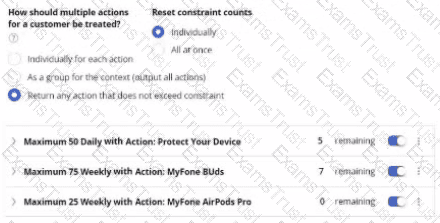

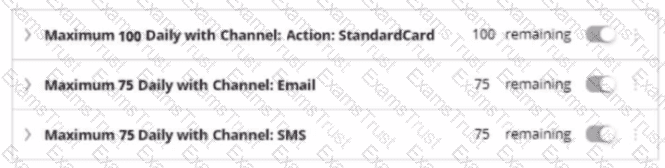

In the following figure, a volume constraint uses the Return any action that does not exceed constraint mode with the three following action type constraints that have remaining limits:

1.Maximum 50 Daily with Action: Protect Your Device, 5 remaining

2.Maximum 75 Daily with Action: MyFone Buds, 7 remaining

3.Maximum 25 Daily with Action: MyFone AirPods Pro, 0 remaining

A customer, CUST-01, qualifies for all the three actions. Given this scenario, how many actions does the system select for CUST-01 in the outbound run?

U+- Bank has recently implemented Pega Customer Decision Hub™. As a first step, the bank went live with the contact center to improve customer engagement. Now, U+ Bank wants to extend its customer engagement through the web channel. As a decisioning architect, you have created the new set of actions, the corresponding treatments, enabled the web channel, and defined a new real-time container trigger in the Next-Best-Action Designer

What else do you configure for the new treatments to be present in the next-best-action recommendations?

U+ Bank, a retail bank, introduced a new mortgage refinance offer in the eastern region of the country. They want to advertise this offer on their website by using a banner, targeting the customers who live in that area.

What do you configure in Next-Best-Action Designer to implement this requirement?

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel. If the following volume constraint is applied, how many actions are delivered by the outbound run?

As a decisioning architect, how can you optimize the strategies that are based on Insights that you gain from the AI Insight feature in the Customer Profile Viewer?

A financial services organization introduces a new policy that limits each customer to two promotional emails per month. To meet compliance requirements, the implementation team must configure this limit in the Next-Best-Action Designer.

Which configuration steps achieve the desired email frequency limit?

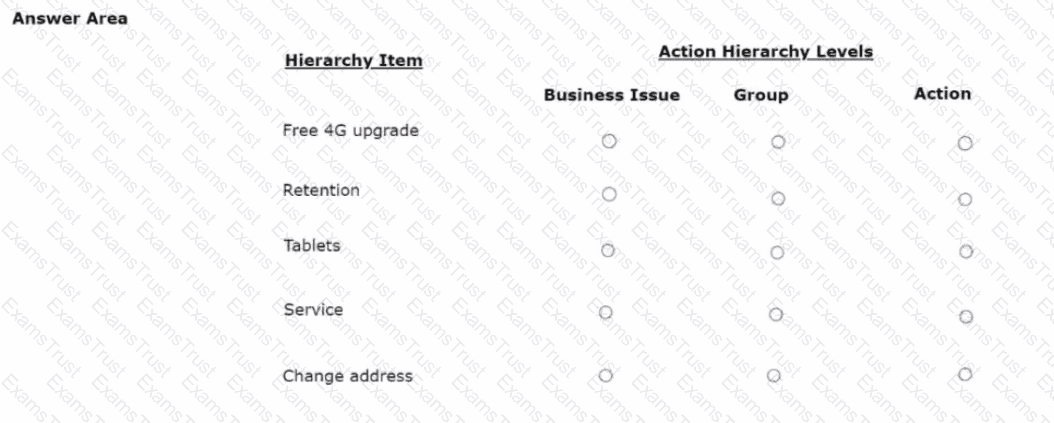

As a decisioning architect, you are setting up the action hierarchy for MyCo. Select the correct action hierarchy level for each of the hierarchy items identified.

U+ Bank, a retail bank, is currently presenting a cashback offer on its website.

Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer:

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45.

As a business user, what are the two tasks that you define to update the cashback offer? (Choose Two)

MyCo, a mobile company, uses Pega Customer Decision Hub™ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning architect, what do you configure to select the best offer from both groups based on customer behavior?

A revision manager needs to deploy changes from the business operations environment to production. The NBA Specialist has completed all build tasks and validated the generated artifacts. The team lead has promoted the change request to the revision manager for deployment processing.

Which step should you take to push the changes to production?

As shown in the following figure, decision strategy contains 'Green Label' and 'Black Label' Proposition components that point to the "Set Printing Cost' Set Property component that uses 'BaseCost' and "LetterCount." The configuration of the Prioritize component selects the lowest cost. What is the role of the Set Property component in the following decision strategy?

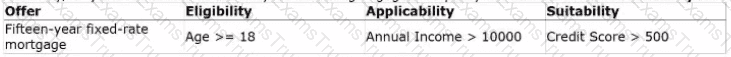

U+- Bank, a retail bank, has recently Implemented a project in which qualified customers see mortgage offers when they log in to the web self-service portal.

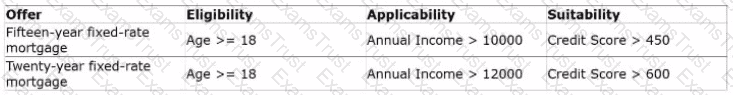

Currently, only the customers who satisfy the following engagement policy conditions receive the Fifteen-year fixed-rate mortgage offer:

The bank decides to make two changes:

1. Update the suitability condition for the Fifteen-year fixed-rate mortgage offer.

2. Introduce a new offer, Twenty-year fixed-rate mortgage.

The following table shows the new engagement policy conditions for both mortgage offers:

What is the best practice to fulfill this change management requirement in the business operations environment?

U+ Bank implemented multiple customer journeys for Its customers. The goal of the bank Is to present the most relevant action for the customer to increase the chance of a positive outcome. U+ Bank is sure that customers see the next best action, regardless of the current journey that they are in.

Which statement is true about customer journeys in Pega Customer Decision Hub?

U+ Bank is facing an unforeseen technical issue with its customer care system. As a result, the bank wants to share the new temporary contact details with all customers over an SMS.

Which type of outbound interaction do you configure to implement this requirement?

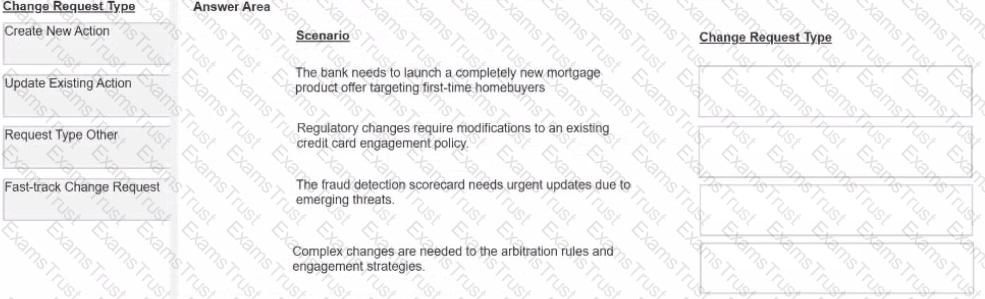

U+ BankT a retail bank, uses Pega Customer Decision Hub™ to manage various business changes throughout their operations The bank's team members need to understand which change request type to use tor different business scenarios they encounter

Select each change request type on the left, and drag it to the matching scenario descriptions on the right:

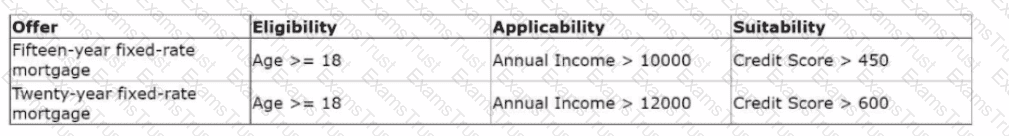

U+ Bank, a retail bank, has recently implemented a project in which qualified customers see mortgage offers when they log in to the web self-service portal.

Currently, only the customers who satisfy the following engagement policy conditions receive the Fifteen-year fixed-rate mortgage offer:

The bank decides to make two changes:

1. Update the suitability condition for the Fifteen-year fixed-rate mortgage offer.

2. Introduce a new offer , Twenty-year fixed-rate mortgage.

The following table shows the new engagement policy conditions for both mortgage offers:

What is the best practice to fulfill this change management requirement in the Business Operations Environment?

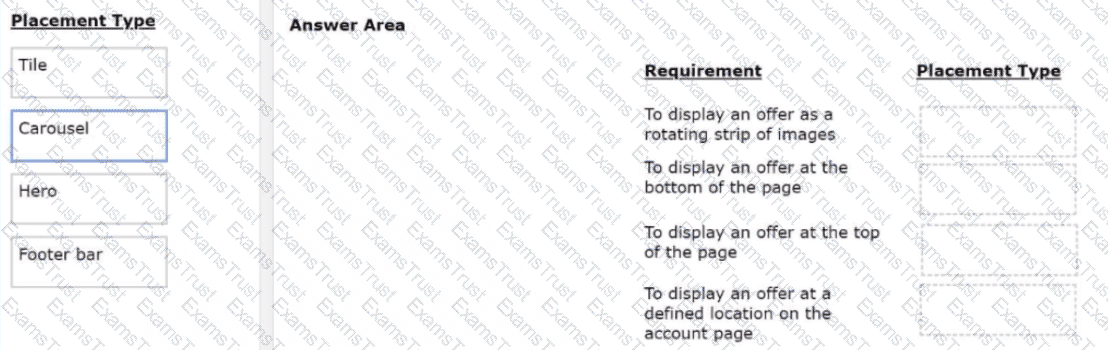

U+ Bank has decided to use the Pega Customer Decision Hub, M to recommend more relevant banner ads to its customers when they visit the personal portal. Select each placement type on the left and drag it to the correct requirement on the right.

U+ Bank implemented a customer journey for Its customers. The journey consists of five stages. The bank observes that as customers progress through the journey, one customer entered the third stage of the Journey, and then received an offer that is not included in any journey.

Which statement explains the cause of this behavior?