You need to identify the root cause for the error that User5 is experiencing.

What should you check?

You need to configure Accounts Receivable to take pre-orders.

Which feature should you use?

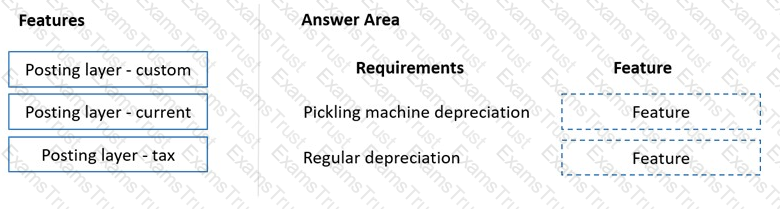

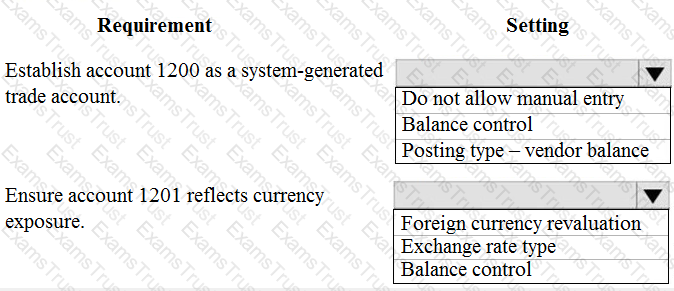

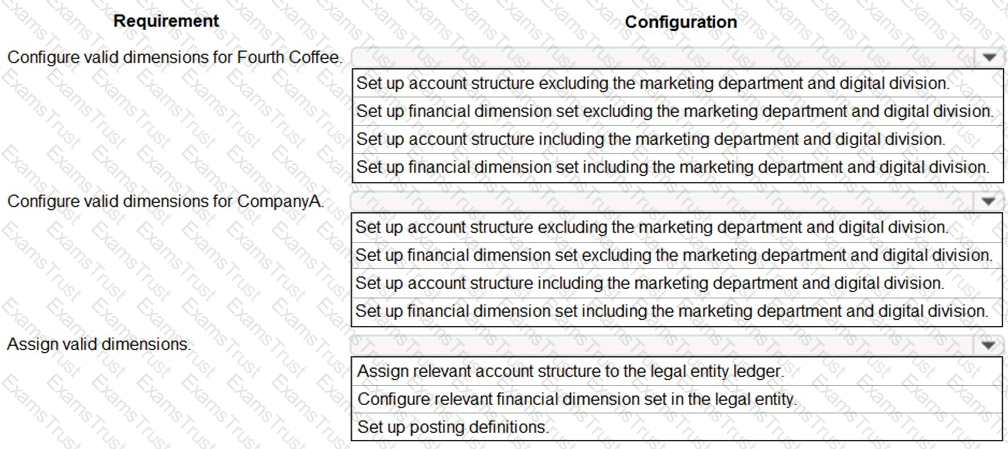

You need to select the functionality to meet the requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

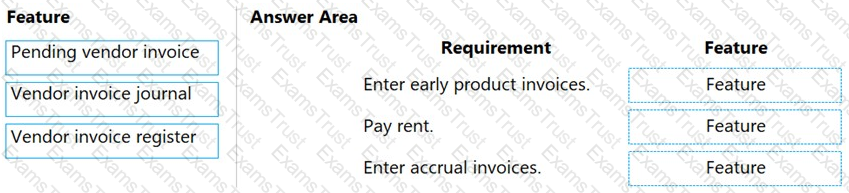

You need to configure the system to meet invoicing requirement.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to process expense allocations.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be used once, more than once, or net at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Which configuration makes it possible for User4 to make a purchase?

You need to recommend a solution to prevent User3's issue from recurring.

What should you recommend?

You need to configure system functionality for pickle type reporting.

What should you use?

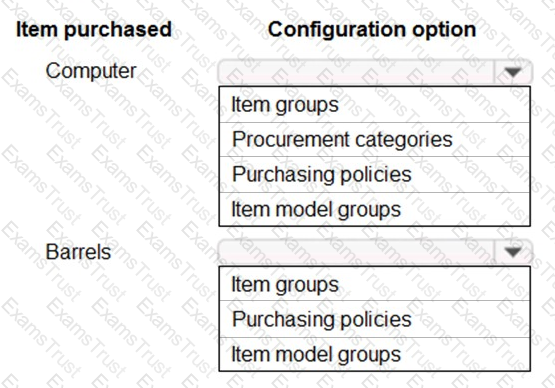

You need to determine the root cause for User1’s issue.

Which configuration options should you check? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

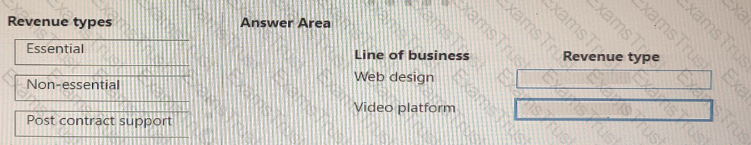

You need to configure recognition.

Which revenue type is associated with the line of business? To answer, drag the appropriate revenue types to the correct lines of business. Each revenue type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to configure the system to meet the fiscal year requirements. What should you do?

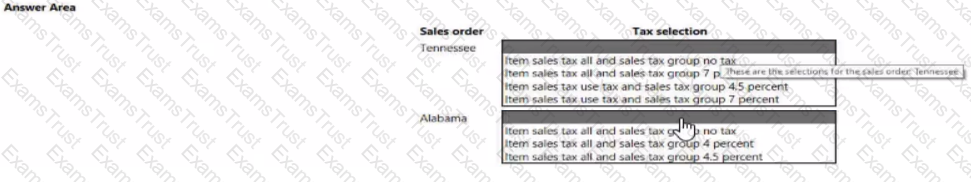

You need to validate the sales tax postings for Tennessee and Alabama.

Which tax selections meet the requirement? To answer. select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.

You need in BUI that captured employee mobile receipts automatic ally match the transactions to resolve the User1 issue.

Which feature should you enable?

You need to ensure that User9's purchase is appropriately recorded.

Which three steps should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

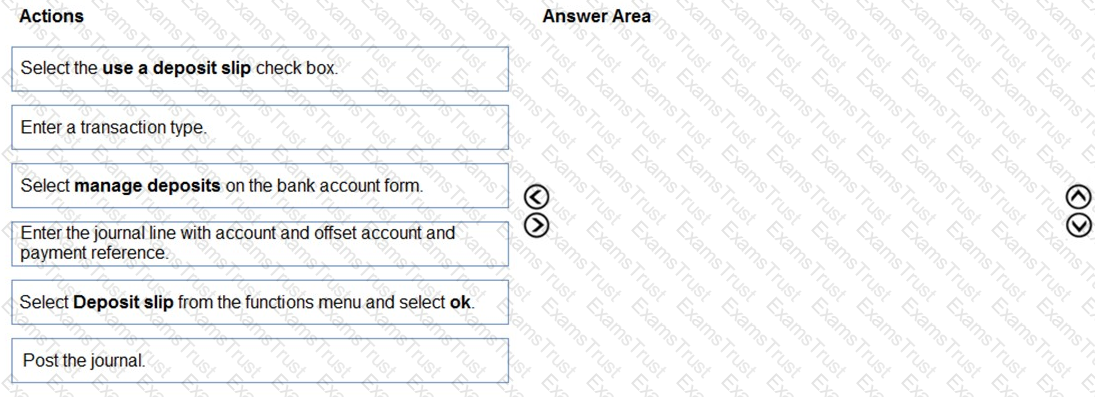

You need to assist User3 with generating a deposit slip to meet Fourth Coffee's requirement.

Which five actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

You need to view the results of Fourth Coffee Holding Company's consolidation.

D18912E1457D5D1DDCBD40AB3BF70D5D

Which three places show the results of financial consolidation? Each correct answer presents a complete

solution.

NOTE: Each correct selection is worth one point.

You need to determine why CustomerX is unable to confirm another sales order.

What are two possible reasons? Each answer is a complete solution.

NOTE: Each correct selection is worth one point.

You need to configure the system to resolve User8's issue.

What should you select?

You need to troubleshoot the reporting issue for User7.

Why are some transactions being excluded?

You need to configure settings to resolve User1’s issue.

Which settings should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

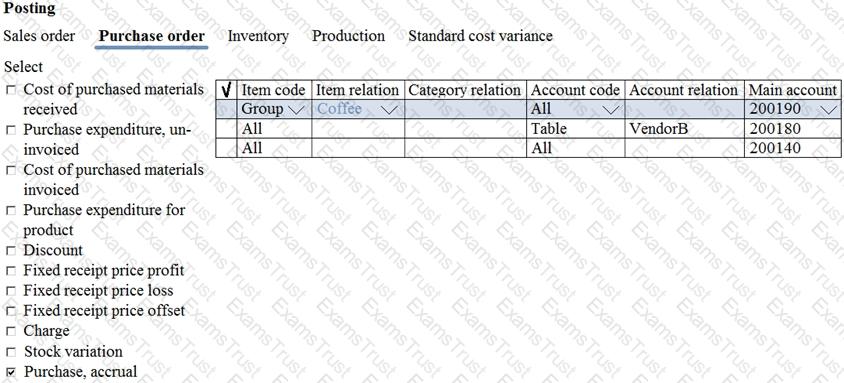

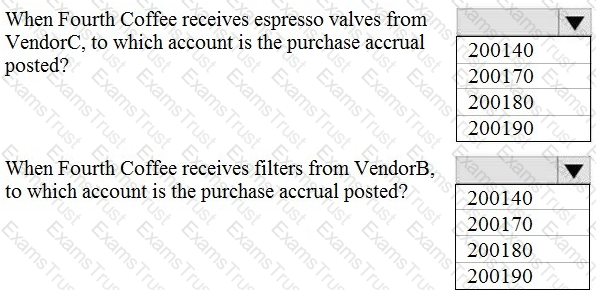

The posting configuration for a purchase order is shown as follows:

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

You need to correct the sales tax setup to resolve User5's issue.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to configure settings to resolve User8’s issue.

What should you select?

You need to prevent a reoccurrence of User2’s issue.

How should you configure the system? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

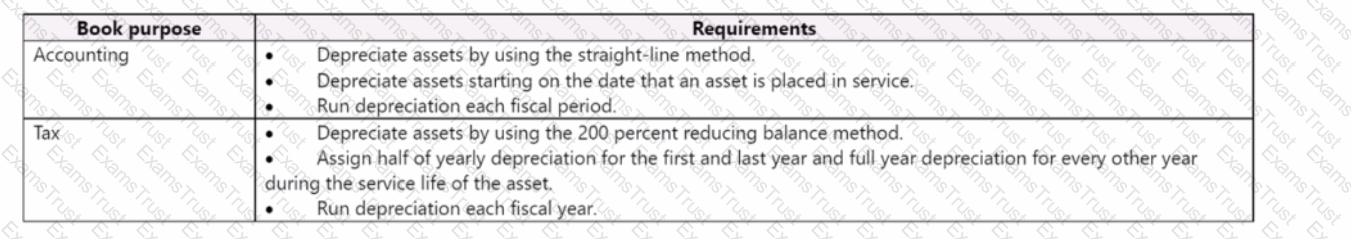

A company uses Dynamics 365 Finance to manage fixed assets. The company's fiscal year is set as the calendar year.

The company requires two books for each fixed asset. The company has the following requirements for the books:

You need to configure a fixed asset group book setup to meet the requirements.

Which depreciation conventions and depreciation profiles should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You are migrating data from a legacy system to Dynamics 365 Finance.

The legacy customer master data does not include a customer grouping. Customers must be assigned to a group.

You need to configure the posting profile.

What should you set up?

You need to set up financial reports to meet management requirements. What should you do? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

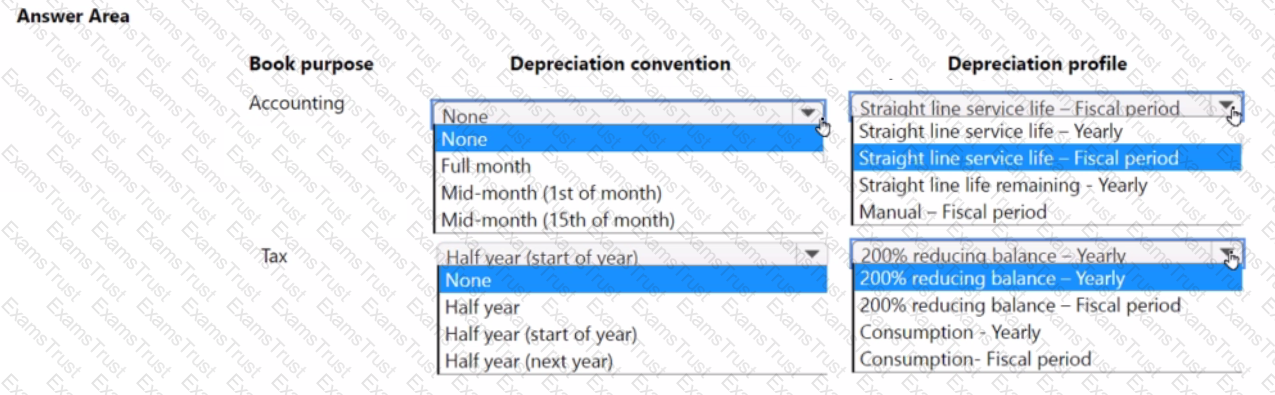

You need to resolve the issue related to monthly lease expenses.

How should you configure asset leasing? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to enforce financial budgets for management and resolve User As issue. What should you do?

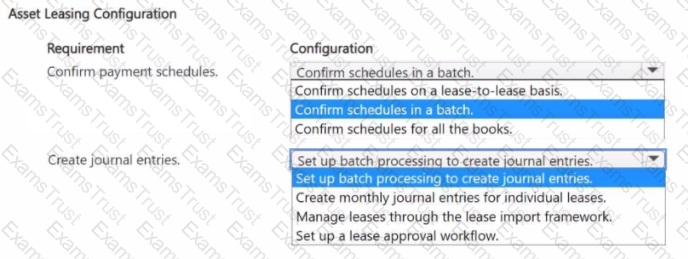

You need to resolve the accounts payable manager issue and resolve the user acceptance testing bug reported by the accounts payable clerk.

How should you configure the system? To answer, move the appropriate Value to the correct Parameter. You may use each Value once, more than once, or not at all. You may need to move the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to resolve the issue that User4 reports.

What should you do?

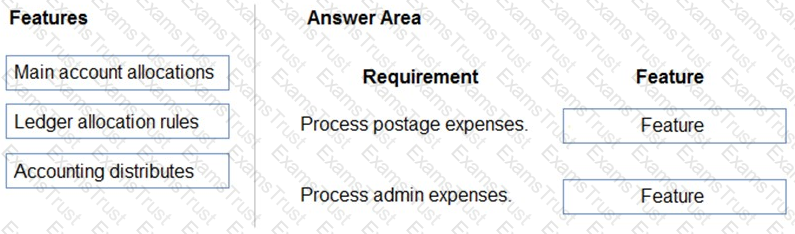

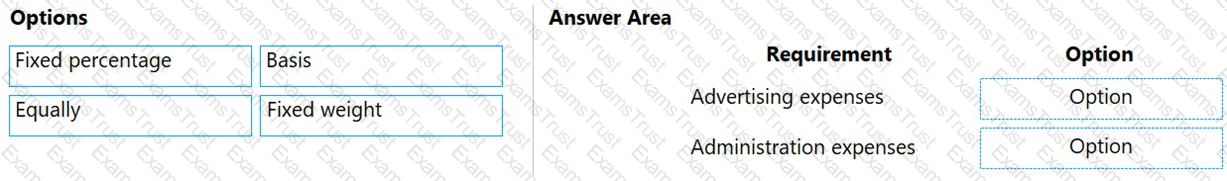

You need to configure ledger allocations to meet the requirements.

What should you configure? To answer, drag the appropriate setups to the correct requirements. Each setup may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

You need to configure budget planning for Alpine Ski House Corporate.

Which two components should you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

You need to adjust the sales tax configuration to resolve the issue for User3.

What should you do?

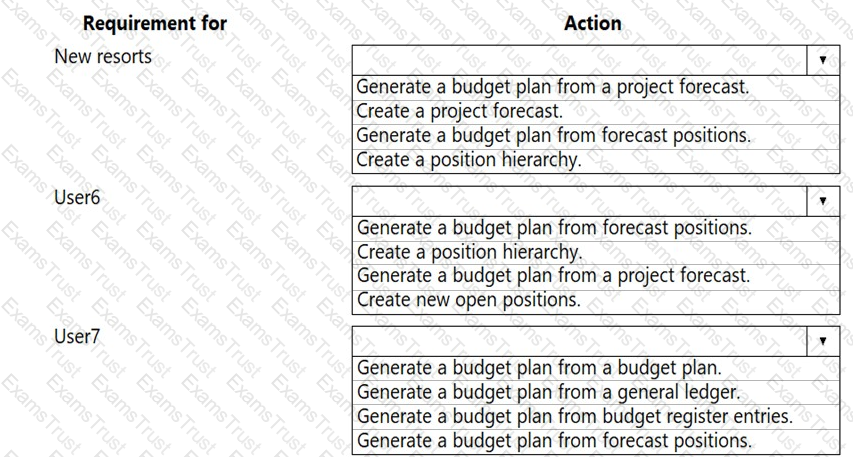

You need to configure the system to meet the budget preparation requirements.

What should you do? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

You need to acquire the fixed assets that are associated with the purchase orders.

What should you do?

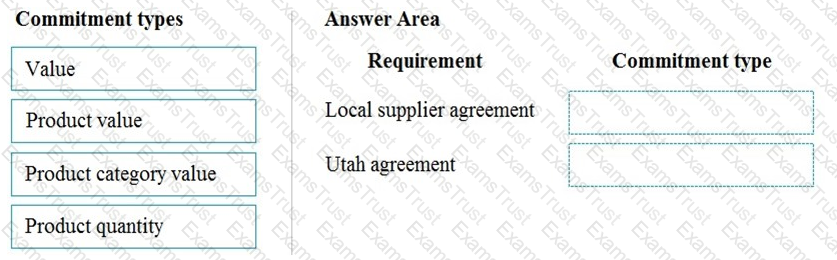

You need to configure the system to for existing purchasing contracts.

Which commitment types should you use? To answer, drag the appropriate commitment types to the correct requirements. Each commitment type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

The Canadian franchise purchases excess ski equipment from the US franchise. Two sets of skis are

purchased totaling USD1,000.

When the purchase invoice is prepared, USD10,000 is keyed in by mistake.

Which configuration determines the result for this intercompany trade scenario?

You need to determine the cause of the issue that User1 reports.

What are two possible causes for the issue? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

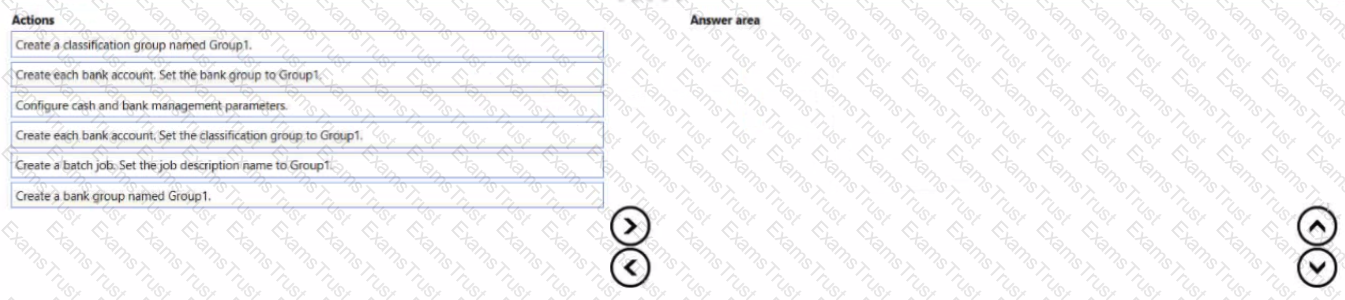

You need to create Trey Research s bank accounts.

Which three actions should you perform in sequence? To answer move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

You need to configure credit card processing for all three companies.

Which option should you use? To answer, select the appropriate options in the answer area

NOTE: Each correct selection is worth one point.

You need to configure the posting groups for Humongous insurance s subsidiary. Which ledger posting group field should you use?

You need to ensure Trey Research meets the compliance requirement.

Which budget technology should you implement? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point

You need to configure the fiscal year calendars for each legal entity.

How should you configure the fiscal year calendars? To answer, select me appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

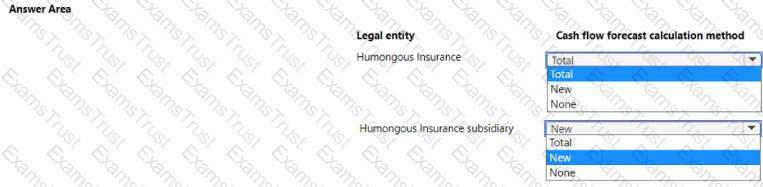

You need to configure the cash flow management reports.

How should you configure cash flow management? To answer, select the appropriate options m the answer area.

NOTE: Each correct selection is worth one point.

You need to configure credit card processing for all three companies

Which option should you use? To answer, select the appropriate options m the answer area

NOTE: Each correct selection is worth one point.

You need to ensure the promotional gifts are posted to the correct account. What should you use?

You need to configure currencies for the legal entities.

configure currencies? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

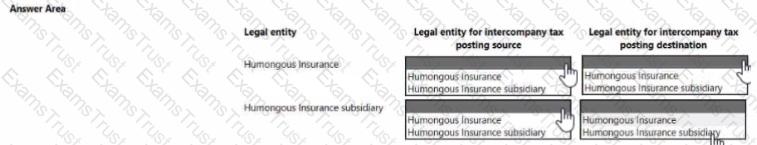

You need to configure expense management tor Humongous Insurance and its subsidiary. Which options should you use? To answer select the appropriate options in me answer area

NOTE: Each correct selection is worth one point.

You need to reconfigure the taxing jurisdiction for Humongous insurance's subsidiary What should you do?

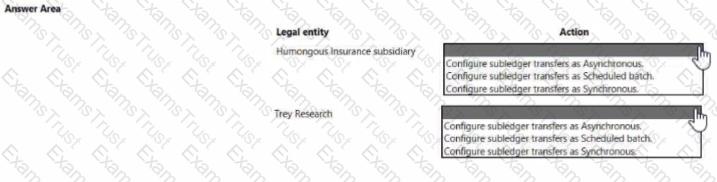

You need to ensure accounting entries are transferred from subledgers to general ledgers.

How should you configure the batch transfer rule? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.