A corporation had foreign currency translation gains from converting the financial statements of its foreign operations into U.S dollars .How will these gains be reported on the corporation’s financial statements?

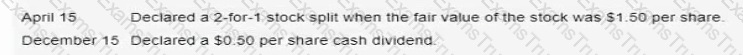

A company had 100.000 shares of common stock issued and outstanding at January 1. During the year, the company took the following actions:

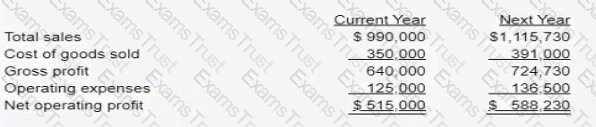

A company has prepared the following pro forma income statements. It plans to sell 10,000 units in the current year and 11.500 units next year.

Hill Corporation sola some of its accounts receivable including one from Custom Company, to Dale incorporated without recourse, Because of this transaction.

Which one of the following is not considered to be a Benefit of participative budgeting?

Which one of the following is the least important for a successful budget process?

Life-cycle costing is most effective when used with products that have a

The price of gold is impacted by many variables A gold-mining company analyst wants to estimate the probability that the price of gold will decline by greater than 10%. Which one of the following approaches is the best analytic tool to use?

Identity two internal factors that enable the Food-To-Go division to have competitive advantages over Its competitors.

Essay

Food Depot Ltd (FDD is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants FDL has been profitable m recent years and has a very strong cash position FDL's newest division. Food-To-Go. is an online meal ordering and delivery platform acquired by FDL two years ago.

In 20X7. sales for the entire company were SI billion, with 50% of the business coming from the Airline Catering division. FDL is the country's leading airline catering services provider and controls 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-Go division only contributed 5% of FDL's total sales in 20X7 and is far behind in competing for market share of the online meal ordering and deliver, industry. It is estimated that Food-To-Go's sales were only 20% of the industry leader's sales However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

The costs of shared corporate services are allocated based on each division s revenue FDL usually caps its capital expenditure budget to 4% of budgeted sales revenue In a recent capital budget coordination meeting. Smith Whitney, the head of the Airline Catering division. complained that his division is underfunded on capital projects . The budgeted capital expenditure had been much less than 4 % of the division’s budgeted sales in the past three years He argued that his division is the company's best-performing division, and it needs more funds to maintain its market share m the industry Whitney wants to reduce the capital expenditure budget for Food-To-Go and reallocate those funds to his division.

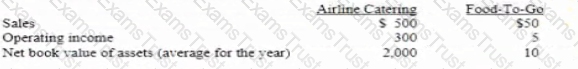

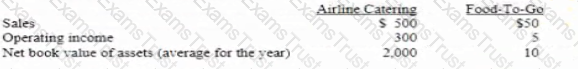

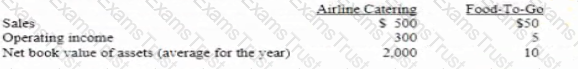

Susan Wiley, the bead of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company Wiley argues that her division had the highest ROI in 20X7. and it deserves more capital funding FDL's required rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follows (in $ millions).

would you recommend any changes to the job responsibilities of ZFl's payroll administrator from an internal control perspective? Explain why.

Essay

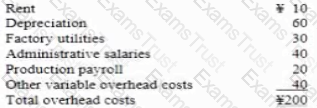

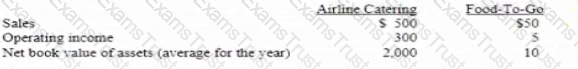

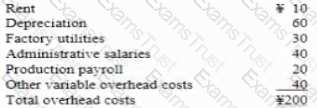

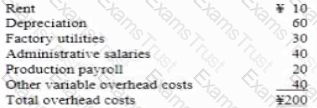

Zhiliang Foods Inc. (ZFI) is a privately-held food distributor ZFI has two production departments' the Meat Department is labor-intensive. while the Bakery Department is highly automated ZFI applies a single overhead allocation rate, using the number of pounds produced as an allocation base for the whole company The expected annual overhead costs of ZFI for 100 million pounds produced are as follows (¥ in millions).

ZFI has one payroll administrator in its Human Resources department, but most of the payroll related work is outsourced to a payroll service provider ZFI's payroll administrator is responsible for tracking the list of current employees and maintaining the most up-to-date employee information, including bank accounts for payroll direct deposits.

Each pay period, the payroll administrator emails the information for all current employees' hours worked to the payroll service provider. The service provider then processes the payroll, makes direct deposits to employees' bank accounts, mails payroll stubs to employees' homes and emails payroll reports to ZFI's payroll administrator. The payroll administrator then makes payroll journal entries to ZFI's accounting system based on the payroll reports received ZFI's accountant prepares a bank reconciliation each month to ensure ZFI s payroll payments on ZFI's bank statement match the amounts shown on the payroll reports from the service provider.

ZFl's management is evaluating the purchase of data encryption software and human resources management software next year. The human resource management software is expected to provide various human resources and payroll-related functions.

In addition, the human resource software can generate a report to indicate the monthly employee turnover rate and the average service length of employees who have resigned. The system can also generate a report to indicate the main reasons for resignations and identify current employees who are at risk of resigning. The system will recommend actions to help retain these employees, such as more training opportunities or a pay raise.

Describe one example of predictive data analytics that the proposed human resources management software can perform.

Essay

Zhiliang Foods Inc. (ZFI) is a privately-held food distributor ZFI has two production departments' the Meat Department is labor-intensive. while the Bakery Department is highly automated ZFI applies a single overhead allocation rate, using the number of pounds produced as an allocation base for the whole company The expected annual overhead costs of ZFI for 100 million pounds produced are as follows (¥ in millions).

ZFI has one payroll administrator in its Human Resources department, but most of the payroll related work is outsourced to a payroll service provider ZFI's payroll administrator is responsible for tracking the list of current employees and maintaining the most up-to-date employee information, including bank accounts for payroll direct deposits.

Each pay period, the payroll administrator emails the information for all current employees' hours worked to the payroll service provider. The service provider then processes the payroll, makes direct deposits to employees' bank accounts, mails payroll stubs to employees' homes and emails payroll reports to ZFI's payroll administrator. The payroll administrator then makes payroll journal entries to ZFI's accounting system based on the payroll reports received ZFI's accountant prepares a bank reconciliation each month to ensure ZFI s payroll payments on ZFI's bank statement match the amounts shown on the payroll reports from the service provider.

ZFl's management is evaluating the purchase of data encryption software and human resources management software next year. The human resource management software is expected to provide various human resources and payroll-related functions.

In addition, the human resource software can generate a report to indicate the monthly employee turnover rate and the average service length of employees who have resigned. The system can also generate a report to indicate the main reasons for resignations and identify current employees who are at risk of resigning. The system will recommend actions to help retain these employees, such as more training opportunities or a pay raise.

Identify one external factor that provides opportunity for the Food-To-Go division.

Essay

Food Depot Ltd (FDD is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants FDL has been profitable m recent years and has a very strong cash position FDL's newest division. Food-To-Go. is an online meal ordering and delivery platform acquired by FDL two years ago.

In 20X7. sales for the entire company were SI billion, with 50% of the business coming from the Airline Catering division. FDL is the country's leading airline catering services provider and controls 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-Go division only contributed 5% of FDL's total sales in 20X7 and is far behind in competing for market share of the online meal ordering and deliver, industry. It is estimated that Food-To-Go's sales were only 20% of the industry leader's sales However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

The costs of shared corporate services are allocated based on each division s revenue FDL usually caps its capital expenditure budget to 4% of budgeted sales revenue In a recent capital budget coordination meeting. Smith Whitney, the head of the Airline Catering division. complained that his division is underfunded on capital projects . The budgeted capital expenditure had been much less than 4 % of the division’s budgeted sales in the past three years He argued that his division is the company's best-performing division, and it needs more funds to maintain its market share m the industry Whitney wants to reduce the capital expenditure budget for Food-To-Go and reallocate those funds to his division.

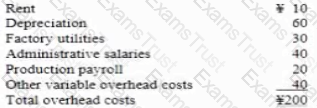

Susan Wiley, the bead of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company Wiley argues that her division had the highest ROI in 20X7. and it deserves more capital funding FDL's required rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follows (in $ millions).

Explain the concept of data encryption and discuss how It may be used to protect the email communications between ZFls payroll administrator and the payroll service provider.

Essay

Zhiliang Foods Inc. (ZFI) is a privately-held food distributor ZFI has two production departments' the Meat Department is labor-intensive. while the Bakery Department is highly automated ZFI applies a single overhead allocation rate, using the number of pounds produced as an allocation base for the whole company The expected annual overhead costs of ZFI for 100 million pounds produced are as follows (¥ in millions).

ZFI has one payroll administrator in its Human Resources department, but most of the payroll related work is outsourced to a payroll service provider ZFI's payroll administrator is responsible for tracking the list of current employees and maintaining the most up-to-date employee information, including bank accounts for payroll direct deposits.

Each pay period, the payroll administrator emails the information for all current employees' hours worked to the payroll service provider. The service provider then processes the payroll, makes direct deposits to employees' bank accounts, mails payroll stubs to employees' homes and emails payroll reports to ZFI's payroll administrator. The payroll administrator then makes payroll journal entries to ZFI's accounting system based on the payroll reports received ZFI's accountant prepares a bank reconciliation each month to ensure ZFI s payroll payments on ZFI's bank statement match the amounts shown on the payroll reports from the service provider.

ZFl's management is evaluating the purchase of data encryption software and human resources management software next year. The human resource management software is expected to provide various human resources and payroll-related functions.

In addition, the human resource software can generate a report to indicate the monthly employee turnover rate and the average service length of employees who have resigned. The system can also generate a report to indicate the main reasons for resignations and identify current employees who are at risk of resigning. The system will recommend actions to help retain these employees, such as more training opportunities or a pay raise.

Discuss how FDL's allocation of shared corporate services costs may overstate the profitability of the Food-To-Go division, and provide your recommendation on shared corporate services costs allocation.

Essay

Food Depot Ltd (FDD is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants FDL has been profitable m recent years and has a very strong cash position FDL's newest division. Food-To-Go. is an online meal ordering and delivery platform acquired by FDL two years ago.

In 20X7. sales for the entire company were SI billion, with 50% of the business coming from the Airline Catering division. FDL is the country's leading airline catering services provider and controls 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-Go division only contributed 5% of FDL's total sales in 20X7 and is far behind in competing for market share of the online meal ordering and deliver, industry. It is estimated that Food-To-Go's sales were only 20% of the industry leader's sales However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

The costs of shared corporate services are allocated based on each division s revenue FDL usually caps its capital expenditure budget to 4% of budgeted sales revenue In a recent capital budget coordination meeting. Smith Whitney, the head of the Airline Catering division. complained that his division is underfunded on capital projects . The budgeted capital expenditure had been much less than 4 % of the division’s budgeted sales in the past three years He argued that his division is the company's best-performing division, and it needs more funds to maintain its market share m the industry Whitney wants to reduce the capital expenditure budget for Food-To-Go and reallocate those funds to his division.

Susan Wiley, the bead of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company Wiley argues that her division had the highest ROI in 20X7. and it deserves more capital funding FDL's required rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follows (in $ millions).

What is ZF's expected variable overhead cost per pound of food produced? Snow your calculations

Essay

Zhiliang Foods Inc. (ZFI) is a privately-held food distributor ZFI has two production departments' the Meat Department is labor-intensive. while the Bakery Department is highly automated ZFI applies a single overhead allocation rate, using the number of pounds produced as an allocation base for the whole company The expected annual overhead costs of ZFI for 100 million pounds produced are as follows (¥ in millions).

ZFI has one payroll administrator in its Human Resources department, but most of the payroll related work is outsourced to a payroll service provider ZFI's payroll administrator is responsible for tracking the list of current employees and maintaining the most up-to-date employee information, including bank accounts for payroll direct deposits.

Each pay period, the payroll administrator emails the information for all current employees' hours worked to the payroll service provider. The service provider then processes the payroll, makes direct deposits to employees' bank accounts, mails payroll stubs to employees' homes and emails payroll reports to ZFI's payroll administrator. The payroll administrator then makes payroll journal entries to ZFI's accounting system based on the payroll reports received ZFI's accountant prepares a bank reconciliation each month to ensure ZFI s payroll payments on ZFI's bank statement match the amounts shown on the payroll reports from the service provider.

ZFl's management is evaluating the purchase of data encryption software and human resources management software next year. The human resource management software is expected to provide various human resources and payroll-related functions.

In addition, the human resource software can generate a report to indicate the monthly employee turnover rate and the average service length of employees who have resigned. The system can also generate a report to indicate the main reasons for resignations and identify current employees who are at risk of resigning. The system will recommend actions to help retain these employees, such as more training opportunities or a pay raise.

Explain the difference between the ROI method and the Rl method in performance evaluation

Essay

Food Depot Ltd (FDD is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants FDL has been profitable m recent years and has a very strong cash position FDL's newest division. Food-To-Go. is an online meal ordering and delivery platform acquired by FDL two years ago.

In 20X7. sales for the entire company were SI billion, with 50% of the business coming from the Airline Catering division. FDL is the country's leading airline catering services provider and controls 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-Go division only contributed 5% of FDL's total sales in 20X7 and is far behind in competing for market share of the online meal ordering and deliver, industry. It is estimated that Food-To-Go's sales were only 20% of the industry leader's sales However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

The costs of shared corporate services are allocated based on each division s revenue FDL usually caps its capital expenditure budget to 4% of budgeted sales revenue In a recent capital budget coordination meeting. Smith Whitney, the head of the Airline Catering division. complained that his division is underfunded on capital projects . The budgeted capital expenditure had been much less than 4 % of the division’s budgeted sales in the past three years He argued that his division is the company's best-performing division, and it needs more funds to maintain its market share m the industry Whitney wants to reduce the capital expenditure budget for Food-To-Go and reallocate those funds to his division.

Susan Wiley, the bead of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company Wiley argues that her division had the highest ROI in 20X7. and it deserves more capital funding FDL's required rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follows (in $ millions).