Succeed Insurance is expanding into California, Texas, and Arizona which have large Spanish-speaking customer bases. Currently language is not considered in assignment. Succeed wants the ability to assign claims to appropriate bilingual Adjusters. Succeed also needs the ability to identify the preferred language of the customers.

The company is planning to implement a slightly modified version of ClaimCenter to suit its organization's needs. The modification will include adding two new required fields to the existing user interface (UI) to capture the reporter's Preferred Language and Preferred Contact Time. This requirement is critical for Succeed to enhance the operational efficiency and expediency of claims processing in its region.

Which two guiding principles apply to this implementation? (Choose two.)

Succeed Insurance allows field Adjusters to write checks directly to the insured to cover damage costs for minor claims such as:

Personal auto claims involving cracked windshields

Homeowners claims involving minor glass breakage

The Adjuster uses the Manual Check Wizard to record the check number and amount against a reserve line. Succeed requires Supervisor approval for all manual checks to ensure that the paper checks are verified against the payment information in ClaimCenter.

Which two limits or rules must be configured in ClaimCenter to ensure that these manual payments are sent to the correct person for approval? (Choose two.)

A catastrophe has been created in ClaimCenter for Tropic Storm Dorian. Succeed Insurance requires that all claims resulting from the storm be attributed to that catastrophe when they are entered in ClaimCenter. The completion target is within three (3) days of claim creation and should be escalated if it is not completed within five (5) days.

Which required element for a business activity rule is missing?

What two pieces of information enable the Business Analyst (BA) to trace back to the root cause of an issue? (Choose two.)

Losses incurred because of an accident with other vehicles can be very large. Because of the risk of large losses, all claims must include both a police report and the details of any passengers in the vehicle, whether they sustained injuries or not. The claim must show whether there were passengers in the vehicle at the time of the accident. Succeed wants the ability to include a very detailed description of the loss event information on intake of the claim.

When the claim is created, Succeed wants to flag the claim with a reminder for the Adjuster to contact the insured.

There should be reminders for the Adjuster to complete the following items for every new claim created:

. Review any photographs of the accident

. Contact and Interview each passenger

. Collect statements from each witness

. Record the vehicle's mileage

Which business requirement is based on assumptions?

An Adjuster at Succeed Insurance creates a check with a partial payment of $1,200 for medical expenses payable to a claimant who was injured in a collision. The check has completed the following processing steps:

. The payment exceeded the Adjuster's authority limits, changing the status to Pending Approval.

. The Adjuster's supervisor reviewed and approved the payment, changing the status to Awaiting Submission.

. A batch process sent the check to the external check processing system, changing the status to Requested when ClaimCenter received an update from the external system.

The Adjuster received new information indicating that the check amount should be reduced to $950.

Which action should the Adjuster take?

What is the importance of a mock-up of the user interface (UI) design?

A claim for an auto accident in California has been assigned to an insurance Adjuster in the Midwest region for investigation and processing. The claim has been flagged as "Low Complexity" in ClaimCenter. The Adjuster has an authority limit for total reserves of $30,000 and has created reserves totaling $35,000.

What is the correct approval routing for this transaction?

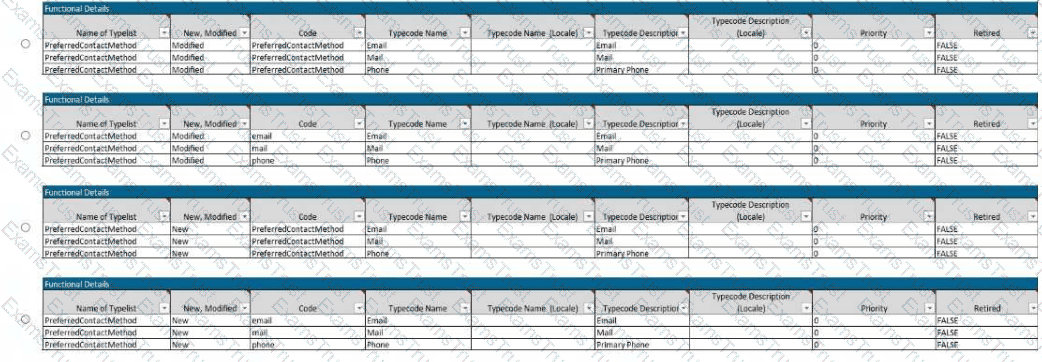

During claim intake and adjudication, Adjusters capture contact information for the insured and all claimants. To improve customer service and reduce the time required to reach these contacts to gather additional claim information, Succeed Insurance will capture the preferred contact method for all person contacts. The new field will be added to the contact details screen of the user interface (UI) as a drop-down list displaying all valid contact methods including email, mail, and phone.

Which version correctly lists the preferred contact methods in the Typelists tab of the Parties Involved User Story Card?

To optimize business process workflow, an insurer has spent a great deal of effort on estimating the amount of effort required to complete various types of work... They are also aware that certain situations may require specialized expertise and want to incorporate this in their decision making.

All claims and exposures are entered using only the ClaimCenter new claim wizard. Once entered, the work should be automatically distributed fairly to those properly suited, as determined by the company's knowledge of each worker's skill set.

Which two assignment mechanisms, alone or together, will achieve their goal? (Choose two.)

Succeed Insurance has plans to expand operations in Greeley, Colorado. Due to a history of hailstorm related damage in the area, the company plans to offer reimbursement for hail damage as an option.

Which two actions should the Business Analyst (BA) take to determine the requirements for the project? (Choose two.)

Succeed Insurance is implementing a slightly modified version of ClaimCenter to suit its organization's needs. The modification will include adding two new required fields to the standard user interface to capture the reporter's Preferred Language and Preferred Contact Time. This requirement is critical for Succeed to improve efficiency and the expediency of claims processing in its region.

Under which ClaimCenter theme will the User Story Card be found for documenting these requirements?

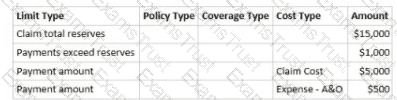

An Adjuster at Succeed Insurance is handling a homeowners claim with a dwelling exposure for damage to the insured's home. The Adjuster's Authority Limit Profile has the following limits:

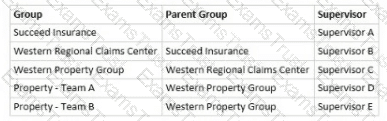

The table below is a view of the property claims organization within Succeed Insurance. The Adjuster is a member of the group Property - Team A.

The Adjuster creates a payment in the amount of $6,500 for repairs to the insured's home. How will it be processed assuming that the claim has sufficient reserves for the payment?

An auto accident in Chicago, Illinois has been reported to Succeed Insurance. The customer service representative uses the ClaimCenter standard Claim Wizard to set up the new claim. The policy is verified in effect and based on the reported exposures the total loss points calculated is 38. There is also a note to have an expert inspection via approved vendor.

What is the most likely claim setup with regards to this reported auto accident?