Saheed is a retiree who is considering splitting his pension income with his wife, Minu.

Which of the following outcomes may occur if he shares his pension benefits?

Jack and Jill hold a mutual fund account as tenants in common. What conditions would apply to their account?

Should either die, full ownership of the account would pass to the other

Each would be the owner of 50% of the account’s assets

Either could issue trading instructions on all account assets

Each would be required to provide KYC information

Derek submits an order to sell 300 units of the Evergreen Canadian Mortgage Fund at 8:00 p.m. EST on Friday, January 6. His proceeds will be based on the net asset value per unit (NAVPU) for which day (assume no holidays)?

A dealing representative explains the past performance of a mutual fund to a potential client, discussing the annual simple returns and compound returns that the fund had earned. She concluded by indicating she expects the fund’s NAVPU was likely to rise at similar rates in the future, given the economic outlook. What unacceptable selling practice has occurred?

What type of risk is the fundamental risk factor for fixed-income securities?

Your client, a high-income earner in a high marginal tax bracket, is seeking to minimize the amount of tax he pays on investment income while continuing to invest in mutual funds. Which mutual fund would best meet his investment objective?

Last year Peter’s earned income from employment was $50,000.

Last year, after receiving a $2 per share in dividends from 500 shares in ABC Inc., a publicly-traded Canadian corporation, he sold his shares. The sale resulted in a capital gain of $15,000.

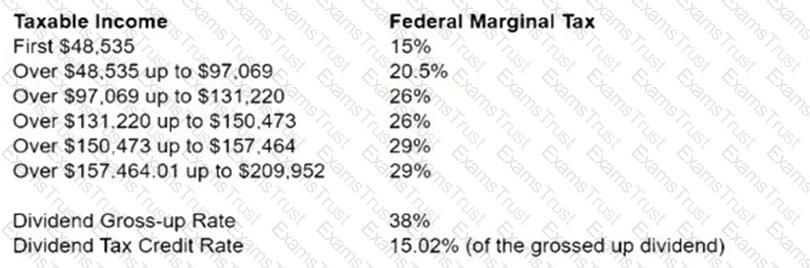

Based on the tax rates mentioned above, what is Peter’s net federal tax liability for the year? (Round to 2 decimal places).

A mutual fund sales representative is asked to make a presentation to an investment club. During the presentation, he discusses personal experiences of a questionable nature. What aspect of Professionalism is relevant to this situation?

A parent wants to put aside savings for his 20-year-old disabled daughter to use at age 65. He prefers funds that require minimal management, while maximizing potential returns during earlier years. Which type of fund is most appropriate, given this parent's objectives?

Which of the following transactions takes place in the secondary market?

The Mutual Fund Dealers Association of Canada (MFDA) has strict rules concerning conflicts of interest. Which of the following is TRUE?

What does a Sharpe ratio of 1 indicate?

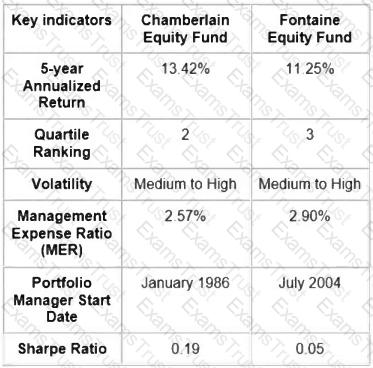

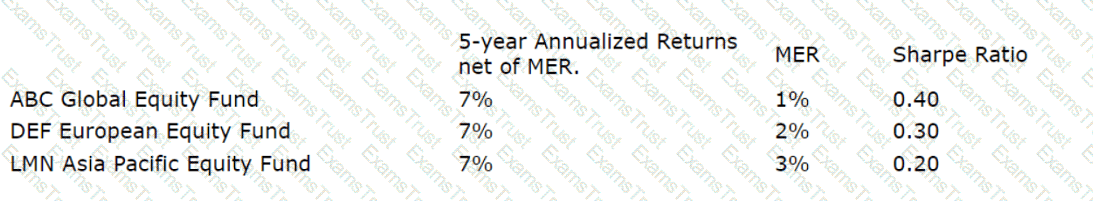

You have been researching Canadian equity mutual funds for a new client. You come across the following information.

What can you conclude from this information?

Why is it important that an investor receive a copy of the Fund Facts document when buying a mutual fund?

Reagan has accepted a role to be the Chief Revenue Officer of a charitable organization. She is currently registered as a Dealing Representative for Sunshine Financial Services.

Which of the following would apply to her?

When selecting an investment to add to a portfolio, what feature would reduce the overall risk?

Which of the following statements about global equity funds is TRUE?

Quintin has been a Dealing Representative for Global Maximum Financial for 5 years. Today, he opened an account for his new client, Reginald. In addition to opening a new account, Reginald agreed to

accept Quintin's investment recommendation and placed a purchase order to buy units of the Global Maximum Value Equity fund.

Quintin informed his Branch Manager Lupita about this new account on the same day the purchase order was received. Lupita told Quintin that she would complete her review of the New Client Application Form (NCAF) by no later than tomorrow.

Which statement regarding this new account opening is CORRECT?

Your client, Helen, just received her non-registered account statement which states that one of her mutual funds made an interest income distribution during the year. She asks you how she will be taxed on the distribution. What do you tell Helen?

What is the time period during which an individual must complete a training program once she starts acting as a dealing representative?

Sarah and Kyle are a married couple. They are both 34 years of age and work as teachers. Their combined annual income is $130,000. They are able to save $800 each month. They own a home worth

$340,000 with a $120,000 mortgage. Since they work for the same employer, they have the same defined benefit pension plan. Other than a tax-free savings account (TFSA) in Kyle's name with $5,000, they do not have any other assets.

They are avid sailors and want to save towards a purchase of a sailboat. For the type of sailboat they want, they estimate it should cost around $65,000. They want you to recommend an investment for their monthly savings to help them achieve their goal faster.

What question should you ask them next?

Last year at age 70, Gregory opened a registered retirement income fund (RRIF). Recently, Gregory unexpectedly received a large cash gift and presently does not need to depend on any payments from his RRIF. He contacts his financial advisor Eric for guidance.

Which of the following statements by his financial advisor would be CORRECT?

How is the annual contribution limit for a TFSA determined?

Sonya, a mutual fund manager for Drake Financial, has had a stellar year in managing their Canadian equity portfolio and has outperformed the benchmark by over 200 basis points. She is now concerned that within the last couple of months of this calendar year, the Canadian equity market is due for a 10 to 15% pullback. Which investment strategy would be most appropriate for her to implement for the last couple of months of the year to offset the market correction?

When comparing mutual funds, what information would help a Dealing Representative determine a suitable mutual fund for a client?

Which example demonstrates direct use of capital savings?

What is a permissible selling practice for mutual fund representatives?

Iliana owns 1,000 participating preferred shares in the First Canadian Bank. Which of the following features are characteristic of her investment?

What is the first step before becoming eligible for registration as a mutual fund dealing representative?

Francis wants to redeem his US Asset Allocation Fund as he needs the money for a down payment for a home purchase. The current proceeds from the redemption are USD $27,859, and the current CAD/USD exchange rate is 0.7353.

How much will Francis receive in Canadian dollars when he redeems the Funds? Please round your answer to the nearest dollar.

What stage in the business cycle typically has increasing wages, rising inflation, rising interest rates with slowing sales, and decreasing business investment?

Louis is the portfolio manager for Quattro Fund. The mandate of the mutual fund is to invest in a combination of cash, fixed income, and equity securities; however, Louis has the ability to adjust the portfolio according to market conditions. If Louis feels that interest rates will fall, he could invest the whole portfolio in equities. If he feels the market is too high, he could take profits and sit totally in cash. What type of mutual fund is Quattro Fund?

Which of the following statements describes a feature of the Home Buyers’ Plan (HBP)?

Which of the following statements is TRUE about the movement of business cycles in the Canadian economy?

An employer wants to offer his employees a pension plan. The goal is to provide a simple-to-understand plan that will reward all participants equally, regardless of their income level, and provide a retirement income based on a participant’s years of service with the company. What plan will best meet his requirements?

Fabiola is an optometrist and an incorporated professional. She has fallen behind schedule regarding saving for retirement. She is considering opening an Individual Pension Plan (IPP).

What provision might encourage her to use an IPP?

The XYZ Canadian Equity Income fund is classified as a large cap Canadian equity fund. Despite overall growth in the Canadian equity markets over the last several years, the fund has underperformed its peer group. What is one possible explanation for the underperformance?

Your clients, Jessica and Ken, want to buy a house next year. You recommend a money market fund. How do you think a money market fund will help Jessica and Ken reach their goal?

Which of the following statements about pension adjustments (PA) is TRUE?

Justin and Yvonne both open a Registered Education Savings Plan (RESP) for their daughter Grace. They plan to regularly contribute $1,000 per year until Grace reaches the age of 17.

Which of the following statements relating to RESP is CORRECT?

Quinton, a Dealing Representative, meets with his client Banji. Banji’s Know Your Client (KYC) indicates that her risk profile is “medium’’. Banji currently has $35,000 in her account which is invested 50% in the Middleton Balanced Fund and 50% in the Hector Growth Fund. She tells Quinton that she would like to contribute an additional $10,000 to purchase the Prospect Labour-Sponsored Fund. Which of the following statements about Banji’s proposed transaction is CORRECT?

Joanne’s earned income last year was $45,000 and her pension adjustment was $2,500. She has $2,000 in carry-forward registered retirement savings plan (RRSP) room for the current taxation year. What is Joanne’s maximum tax-deductible RRSP contribution amount for the current year?

Which client has demonstrated the endowment behavioural bias?

Which of the following statements is true when comparing fund of funds to traditional mutual funds?

Which statement CORRECTLY describes index mutual funds and traditional exchange-traded funds (ETFs)?

Which of the following statements about capital gains distributions from mutual fund trusts is correct?

A fund manager has diversified the equity portfolio he manages in order to reduce the potential negative impact of unfavorable information relating to any one stock. What type of risk has he reduced?

Raybert has a very short-term investment objective and has decided to purchase money market instruments. There are plenty of 90-day money market securities available for him to choose from. Although Raybert is aware that all the respective issuers have a similar need for his capital, no matter what he decides, he can only afford to purchase one.

In terms of financial markets and their relationship to the principles of supply and demand, which characteristic of investment capital are the issuers being exposed to?

Portia is a Dealing Representative with Highview Wealth Inc., a mutual fund dealer. Portia recommends the Stature Growth Fund to her client Clive. Which of the following CORRECTLY describes what Portia must do in order to satisfy her obligations under the Client Relationship Model (CRM) and Client Focused Reforms (CFR)?

As a measurement of risk, which of the following statements about beta is TRUE?

During the calendar year, Firmansyah received a $1,800 eligible dividend from a large Canadian bank and a foreign, dividend from his The USD/CAD exchange rates is 1.3605.

Firmansyah’s federal marginal tax bracket is 29%. The enhanced dividend gross-up rate is 38% and the federal dividend tax credit rate for eligible dividends is 15%.

What federal tax liability will be due from the investment income?

Which conduct standard addresses personal financial dealings with clients?

What type of mutual fund seeks to provide a positive real rate of return, through both income and capital appreciation, by investing in a diversified portfolio of fixed income securities, as well as Canadian and foreign equity securities?

Ken is a member of his employer’s Defined Benefit Pension Plan (DBPP). Which of the following statements about Ken’s plan is CORRECT?

Cristina wants to add a mutual fund to her portfolio offering dividend income. She is considering either a preferred dividend fund or a standard equity fund. What is an important difference for Cristina to consider when comparing these two types of funds?

While assessing the suitability of an investment recommendation as a Dealing Representative, which statement applies to the "Client's Interest First" standard?

Terri, 30 years old, is the marketing manager at Provincial Winery with an average annual income of $60,000. Her spouse Yvette, 28 years old, is a project manager with a telecommunications firm earning

$70,000 per year. You are helping them to organize their investments and are trying to assess their financial resources.

Which of the following is the best question to ask?

How might a registrant provide beneficial mutual fund advice and service?

What type of fund offers the highest expected risk and the highest expected return in terms of the risk-return trade-off between different types of mutual funds?

What information does Fund Facts provide to potential investors?

How does the life-cycle hypothesis assist an advisor while interacting with clients?

Ian is 25, employed, and has no dependents. He has no current financial or family obligations. He has asked for your recommendation for investing a $50,000 inheritance. What asset allocation would typically suit an investor with Ian’s characteristics?

Pippa purchased a 15-year bond with a face value of $5,000 and a 7% coupon rate at the time of issuance. The bond is due to mature later this year. The general interest rate climate remained stable for the first 13 years of the bond's term. However, especially over the past 18 months, both inflation and general interest rates have increased more than expected.

What is Pippa likely to experience from her bond?

What type of fee does a mutual fund sponsor often reduce the longer an investor holds a back-end load fund?

Last year, a hedge fund had a gross return of 22%. The hurdle rate was 5%, and the incentive fee was 20%. What percentage compensation would the fund manager earn for this strategy, assuming no other fees exist?

Anthony purchased 500 units of XYZ Fund at a price of $12.00 per unit. Near the end of the year, the mutual fund made a distribution of $1.50 per unit. The net asset value per unit (NAVPU) immediately before the distribution was $16.50. Anthony immediately reinvested his distribution at the new NAVPU. How many new units did Anthony purchase when his distribution was reinvested?

An investor wishes to add another security to his portfolio. He is looking at a stock that has a correlation with the portfolio of 0.99. What should the advisor tell this investor?

Which of the following form part of the disclosure documents relating to mutual funds?

Sachin owns units of a long-term bond fund. He has heard that the Bank of Canada is likely to make it more expensive to borrow money. He is worried that the value of his investment is going to drop. What sort of investing risk is Sachin experiencing?

How is a $10,000 withdrawal from a registered retirement savings plan (RRSP) taxed?

What activity is expected of mutual funds registrants?

Xerxes, 45 years old, is a successful architect, having an annual income of $185,000. He has around $10,000 in his non-registered account, which he is looking to invest in a tax-efficient manner.

From the following options, which would be the most tax-efficient?

Nelson is a Dealing Representative with True Wealth Advisors Inc., a mutual fund dealer. Nelson follows proper procedures related to his firm’s Relationship Disclosure Information (RDI). Which of the following CORRECTLY describes how Nelson is permitted to evidence that he satisfied his RDI obligation?

What term refers to surplus cash flow after expenses have been paid?

Seth's brother Keith manages a successful private equity fund. Seth is an investment advisor and has thoroughly evaluated Keith's fund. He believes it would be an excellent investment for some of his clients. If Seth does not disclose his relation to Keith prior to recommending this investment, what value does he stand to breach with his client?

What type of managed fund, recently introduced to Canada, is allowed greater use of short sales, leverage, and derivatives compared to mutual funds, but not to the same extent as hedge funds?

Which type of fund is least likely to produce capital gains income?

A client wishes to deal with one registered representative for both banking services and mutual fund investments. The client would also like advice on determining where best to place their money to enhance their overall tax situation as they approach buying a home. Which individual is best suited for this service if the client's goal is to build a long-term advisor-client relationship?

What statement CORRECTLY describes a key difference between bonds and debentures?

One of your clients, Harry, has heard that he can defer paying tax on capital gains. He wants to know if what he has heard is correct and if so, how to defer paying taxes on capital gains.

What would you tell Harry?

Which statement best describes one of the main differences between short and long transactions?

Why is it important to include ethical decision-making as a Standard of Conduct?

The Corporation Group is seeking financing for the purchase of new equipment for a planned expansion. They want to use the funds for a period of five years. They do not want to pledge any of their existing assets as security or extend shares to any of their debtors. Additionally, they want the privilege of repaying borrowed funds at any time if they so choose. What is the most ideal fixed-income security they should issue to raise this capital?

A mutual fund representative misrepresents the risks associated with a particular mutual fund in order to encourage a conservative client to purchase it. What part of MFDA Rule No. 2 “Business Conduct” did the representative violate?

Megan purchases a treasury bill for $98,200. When it matures for $100,000, how does Megan treat the $1,800 difference?

What purpose does it serve for non-money market mutual funds to hold money market instruments?

Ayra believes the Canadian economy will be booming for the next five years. Which mutual fund can provide Ayra with the most tax efficiency if she keeps her investment in a non-registered account?

A client had set up a voluntary accumulation plan to invest a set amount annually in December in an equity mutual fund. They decided to move to a pre-authorized plan where they will invest a smaller amount in this fund every week. What is likely the most significant benefit of this change?

In the OTC market, who enters the bid and ask quotations?

Sharon short-sold 7,500 shares of LMP at $85. She later buys back the short position at $95. Sharon was charged a 1% commission on the proceeds for both the short sale and buyback transactions. What is Sharon's profit or loss?

Daisy is a Dealing Representative registered in the province of Saskatchewan only. Daisy’s client, Orville, a resident of Lloydminster, Saskatchewan is a retiree who presently has a $1,000,000 with her dealer, Easy Ride Financial. Orville is now planning to move to Vegreville, Alberta next month. Easy Ride Financial is registered in Alberta and Saskatchewan. Neither Easy Ride Financial nor Daisy have any clients who are resident in Alberta.

Which of the following should Daisy do if she wants to continue to service Orville’s account?

When can an individual legally start selling mutual funds?

Sofie is a busy mutual fund sales representative. She would like to move clients that are invested in low-yielding cash accounts to her firm’s higher-yielding proprietary money market mutual fund. She confirms the orders with the clients, then instructs her new sales assistant, who will write the IFC exam next week, to enter orders to buy units in this fund. How has Sofie violated the standards of conduct?

An unlicensed person was hired at a securities administrator, and they accepted their first case, which may result in suspending a registrant's license. The new hire immediately requests a subpoena of witnesses (and evidence) and requests guidance from the FATF. What error did the new hire likely commit?

Which of the following individuals would qualify for a full or partial Old Age Security (OAS) pension?

You are meeting a new client, Steven, and you are trying to determine his level of understanding of different investments. Which question would give you the most information regarding your client's familiarity with investing?

What do Guaranteed Income Supplement (GIS) and Allowance for the Survivor have in common?

One of your clients, Sheldon, is 65 years old. He has $30,000 to invest. He has a low risk profile, and an investment objective of receiving regular income. He has a time horizon of 5 years.

Based on Sheldon's risk profile and investment objective, which of the following investment recommendations is MOST appropriate for Sheldon?

Lydia wants to transfer units of her Sussex Growth Fund to her registered retirement savings plan (RRSP) as her RRSP contribution. The current market value is $10,600 and the cost of the units is $4,500.

Which of the following statements is CORRECT?

Which of the following asset allocation statements is correct?

Which of the following is a characteristic of a bond fund?

What type of unemployment is caused by a lack of skilled workers?

What is the current yield on a $5,000 Government of Canada bond paying a 6% coupon and trading at a price of $102 (rounding to the nearest hundredth)?

In what circumstance would an investor receive a T3 or T5 reporting a capital gain from a mutual fund investment?

Which among the following BEST describes a company's retained earnings statement?

10 years ago, Felipe opened a registered retirement savings plan (RRSP) account and purchased a mutual fund. The mutual fund purchased included a 7-year deferred sales charge (DSC). At the time of making his investment, him and his Dealing Representative agreed that he had a 25-year growth objective. Since Felipe knew that he was not planning to use his investment until he retired, he was not

concerned about the DSC. Although the rate of return did vary from year-to-year, he never noticed his mutual fund having a drop in value. This gave Felipe more confidence in the investment. As a result, he has never made any changes to his investment.

What category of Know Your Client (KYC) information has been given?

In which of the following situations would the client mobility exemption apply?

Winter is a Dealing Representative with Top Tier Investing, a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Which of the following statements about Winter's

suitability obligation is CORRECT?

Winter is required to make a suitability determination every time:

i) she makes a recommendation to a client

ii) a client's investment returns decline.

iii) she opens a new client account

iv) the markets fluctuate.

Which financial leverage ratio measures a company’s ability to repay its borrowings?

What type of risk remains unaffected by diversification?

What is the securities administrator’s power that is intended to ensure investors can make fully informed investment decisions?

What is the maximum yearly CESG available to a family earning $150,000 annually?

Which of the following best describes implied needs of your clients?

Irina Pluskova is a financial advisor for a multi-national firm. She is a well-known personality within the local community for her philanthropic work with children's charities. What must Irina do to uphold the Standards of Conduct?

The following table shows Sabrina's earned income for the past few years:

Sabrina has always maximized her RRSP contributions, so she has no carry-forward room available. If the maximum contribution limit for Year 3 is $24,270, what is her RRSP contribution room for Year 3?

Sven owns preferred shares that give him the option to sell his holdings back to the issuing company at a predetermined price and within a specified time. What type of preferred shares does Sven own?

Nancy received a $160 taxable dividend from Can-Star Ltd., whose shares she holds in her non-registered account. Can-Star is a taxable Canadian corporation. What is the approximate amount of the dividend tax credit Nancy will receive on the shares?

What term describes the range of possible future outcomes on the price of a security?

What is the role of a custodian?

Yesterday, Mariana who is new to investing and purchased mutual funds for the very first time. She shared her excitement with her good friend, Julius. However, after Julius learned about her investment, he admits that he had a bad experience with mutual fund investing and that he lost money. Mariana regrets not talking to Julius prior to making her decision. Her feelings of enthusiasm have changed to fear. She is wondering if it is too late to change her mind and cancel her purchase order.

Which statement regarding the right of withdrawal is CORRECT?

What equity investment philosophy places greater emphasis on industry weighting than on security selection?

When must client complaints be acknowledged in writing?

What amount of Canadian taxes would an investor with a 33% marginal tax rate pay on a $5,000 dividend payment from a foreign corporation?

Which of the following characteristics about mortgage mutual funds is CORRECT?

Which among the following BEST describes a company’s income statement?

Ai Fen has recently become registered to sell mutual funds with Acadian Eastern Financial, a mutual fund dealer. Ai Fen determined that with her background of being a Chartered Financial Analyst, she can help people understand the nature of investing more easily than others in her field.

Which registration category will need to be prominently noted on Ai Fen’s business card to comply with the “holding out rule”?

Which newspaper article would be likely to result in foreign capital moving out of a country?

A sales representative has accepted an instruction from a relatively new client to liquidate all positions and wire the proceeds. This request appears rather unusual and suspicious, so she escalates this to her compliance department. To whom should the compliance department report these transactions?

Dale will be using his mutual fund portfolio to supplement his income from other sources. He is comfortable with variable payouts and fluctuating markets. What is the best solution for Dale?

Carol contributed $500 to her TFSA. $350 was invested in ABC Bank Canadian equity fund and $150 in the ZYX Global growth fund. The expected return for the funds is 8% and 9.8%, respectively. What is the expected return on her TFSA?

Your client Charlie is thinking about making a large investment into the Sentinel Canadian Equity Fund on December 15. The ex-dividend date for the mutual fund is December 20. What advice would you give

Charlie to avoid the tax trap?

Which statement regarding Canada's income tax system is CORRECT?

Danny is a Dealing Representative for Everbright Investments. He met with his client Adele, who has $1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?

Janine will celebrate her 71st birthday this year. She currently has a lot of money in a personal registered retirement savings plan (RRSP) and knows there are rules about what she can do with those funds. Which of the following is TRUE?