MAN is a manufacturing company that is based in country M and sells almost exclusively to customers in country M, priced in the local currency, M$.

MAN wishes to expand the business by acquiring a company that manufactures similar products but has a more global customer base. It is particularly interested in selling to customers in country P, which uses currency P$ but recognises that the P$ is generally quite volatile against the M$.

Country P uses the same language as country M, has free entry of labour from country M, no exchange controls or withholding tax and a favourable double tax treaty.

Which of the following companies would be most suitable takeover candidates for MAN to investigate further?

Company AB was established 6 years ago by two individuals who each own 50% of the shares.

Each individual heads a separate division within the company, which now has annual turnover of GBP10 million and employs 40 people.

Some of the employees are very highly paid as they are important contributors to the company's profitability.

The owners of the company wish to realise the full value of their investment within the next 12 months.

Which TWO of the following options are most likely to be acceptable exit strategies to the two owners of the company?

A company's directors plan to increase gearing to come in line with the industry average of 40%. They need to know what the effect will be on the company's WACC.

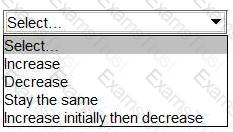

According to traditional theory of gearing the WACC is most likely to:

Assume today is 31 December 20X1.

A listed mobile phone company has just launched a new phone which is proving to be a great success.

As a direct result of the product's success, earnings are forecast to increase by:

• 5% a year in each of years 20X2 – 20X6

• 3% from 20X7 onwards

Market analysts were very excited to hear the news of the success of the product and future growth forecasts.

Assuming a semi-efficient market applies, which of the following company valuation methods is likely to give the best estimate of the company's equity value today?

A company plans to raise $12 million to finance an expansion project using a rights issue.

Relevant data:

• Shares will be offered at a 20% discount to the present market price of $15.00 per share.

• There are currently 2 million shares in issue.

• The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

A private company was formed five years ago and is currently owned and managed by its five founders. The founders, who each own the same number of shares have generally co-operated effectively but there have also been a number of areas where they have disagreed

The company has grown significantly over this period by re-investing its earnings into new investments which have produced excellent returns

The founders are now considering an Initial Public Offering by listing 70% of the shares on the local stock exchange

Which THREE of the following statements about the advantages of a listing are valid?

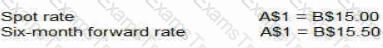

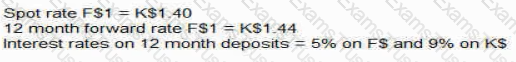

Company A operates in country A with the AS as its functional currency. Company A expects to receive BS500.000 in 6 months' time from a customer in Country B which uses the B$.

Company A intends to hedge the currency risk using a money market hedge

The following information is relevant:

What is the AS value of the BS expected receipt in 6 months' time under a money market hedge?

It is now 1 January 20X0.

Company V, a private equity company, is considering the acquisition of 40% of the equity of Company A for a total amount of $15 million.

Company A has been established to develop a new type of engine which will be launched at the end of 20X1. Company A is forecasting that the new engine will result in free cash flows to equity of $2m in its first year of operation and that this will rise by 8% per year for the foreseeable future.

The new engine is the only commercial activity that Company A is involved in.

Company V intends to sell its stake in Company A when the new engine is launched.

Company A has a cost of equity of 12%.

Assuming that Company V receives an amount that reflects the present value of their shares in company A. what is the estimated annual rate of return to Company V from this investment? (To the nearest %)

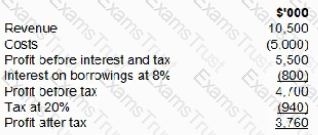

A company is considering taking out $10.000,000 of floating rate bank borrowings to finance a new project. The current rate available to the company on floating rate barrowings is 8%. The borrowings contain a covenant based on an interested cover of 5 times.

The project is expected to generate the following results:

At what interest rate on the floating rate borrowings is the bank covenant first breached?

A company needs to raise $20 million to finance a project.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.

The competition authorities are investigating the takeover of Company Z by a larger company, Company Y.

Both companies are food retailers.

The takeover terms involve using a part cash, part share exchange means of payment.

Company Z is resisting the bid, arguing that it undervalues its business, while lobbying extensively among politicians to sway public opinion against the bidder.

Which of the following actions by Company Y is most likely to persuade the competition authorities to approve the acquisition?

A company enters into a floating rate borrowing with interest due every 12 months over the five year life of the borrowing.

At the same time, the company arranges an interest rate swap to swap the interest profile on the borrowing from floating to fixed rate.

These transactions are designated as a hedge for hedge accounting purposes under IAS 39 Financial Instruments: Recognition and Measurement.

Assuming the hedge is considered to be effective, how would the swap be accounted for 12 months later?

Which THREE of the following are likely to be strategic reasons for a horizontal acquisition?

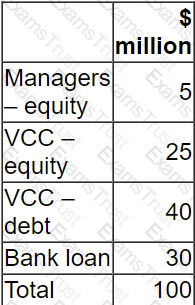

A company intends to sell one of its business units, Company R by a management buyout (MBO).

A selling price of $100 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal:

The VCC requires a minimum return on its equity investment in the MBO of 30% a year on a compound basis over 5 years.

What is the minimum TOTAL equity value of Company R in 5 years time in order to meet the VCC's required return?

Give your answer to one decimal place.

$ ? million

A company is wholly equity funded. It has the following relevant data:

• Dividend just paid $4 million

• Dividend growth rate is constant at 5%

• The risk free rate is 4%

• The market premium is 7%

• The company's equity beta factor is 1.2

Calculate the value of the company using the Dividend Growth Model.

Give your answer in $ million to 2 decimal places.

$ ? million

A national airline has made an offer to acquire a smaller airline in the same country.

Which of the following would be of most concern to the competition authorities?

Company A has just announced a takeover bid for Company B. The two companies are large companies in the same industry_ The bid is considered to be hostile.

Company B's Board of Directors intends to try to prevent the takeover as they do not consider it to be in the best interests of shareholders

Which THREE of the following are considered to be legitimate post-offer defences?

A company has identified potential profitable investments that would require a total of S50 million capital expenditure over the next two years The following information is relevant.

• The company has 100 million shares in issue and has a market capitalisation of S500 million

• It has a target debt to equity ratio of 40% based on market values This ratio is currently 30%

• Earnings for the current year are expected to be S1 00 million

• Its last dividend payment was $1 per share One of the company's objectives is to increase dividends by at least 10% each year

• The company has no cash reserves

Which of the following is the most suitable method of financing to meet the company's requirements?

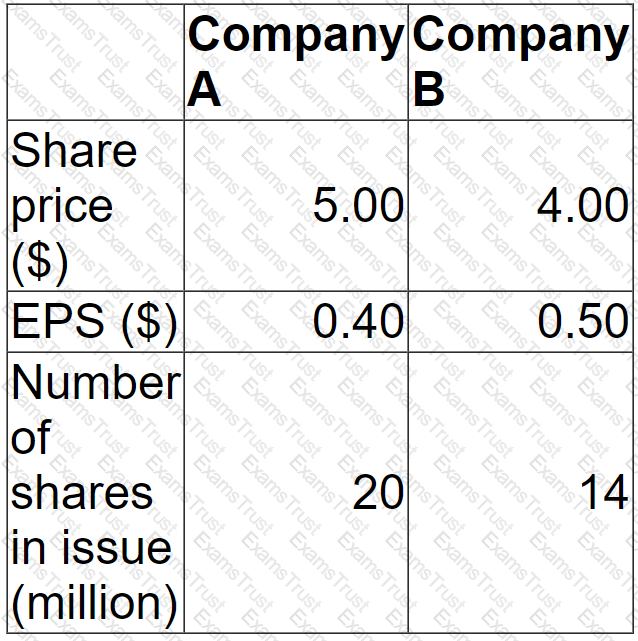

Company A is planning to acquire Company B at a price of $ 65 million by means of a cash bid.

Company A is confident that the merged entity can achieve the same price earnings ratio as that of Company A.

What does Company A expect the value of the merged entity to be post acquisition?

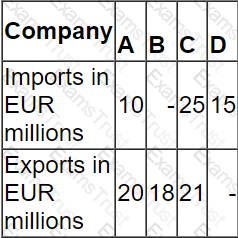

Companies A, B, C and D:

• are based in a country that uses the K$ as its currency.

• have an objective to grow operating profit year on year.

• have the same total levels of revenue and cost.

• trade with companies or individuals in the eurozone. All import and export trade with companies or individuals in the eurozone is priced in EUR.

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the EUR/K$ exchange rate?

WX, an advertising agency, has just completed the all-cash acquisition of a competitor, YZ. This was seen by the market as a positive strategic move byWX.

Which THREE of the following will WX's shareholders expect the company's directors to prioritise following the acquisition?

Which THREE of the following non-financial objectives would be most appropriate for a listed company in the food retailing industry?

Company T has 1,000 million shares in issue with a current share price of $10 each.

Company V has 300 million shares in issue with a current share price of $5 each.

Company T is considering acquiring Company V.

Total synergy gains of $100 million have been estimated.

The purchase of Company V's shares would be by cash at a 10% premium above the current share price.

In seeking approval for the acquisition, the likely reaction from T's shareholders will be:

A company has in a 5% corporate bond in issue on which there are two loan covenants.

• Interest cover must not fall below 3 times

• Retained earnings for the year must not fall below $3.5 million

The Company has 200 million shares in issue.

The most recent dividend per share was $0.04.

The Company intends increasing dividends by 10% next year.

Financial projections for next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

Company YZZ has made a bid for the entire share capital of Company ZYY

Company YZZ is offering the shareholders in Company ZYY the option of either a share exchange or a cash alternative

Which THREE of the following would be considered disadvantages of accepting the cash consideration for the shareholders of Company ZYY?

A company's latest accounts show profit after tax of $20.0 million, after deducting interest of $5.0 million. The company expects earnings to grow at 5% per annum indefinitely.

The company has estimated its cost of equity at 12%, which is included in the company WACC of 10%.

Assuming that profit after tax is equivalent to cash flows, what is the value of the equity capital?

Give your answer to the nearest $ million.

$ ? million

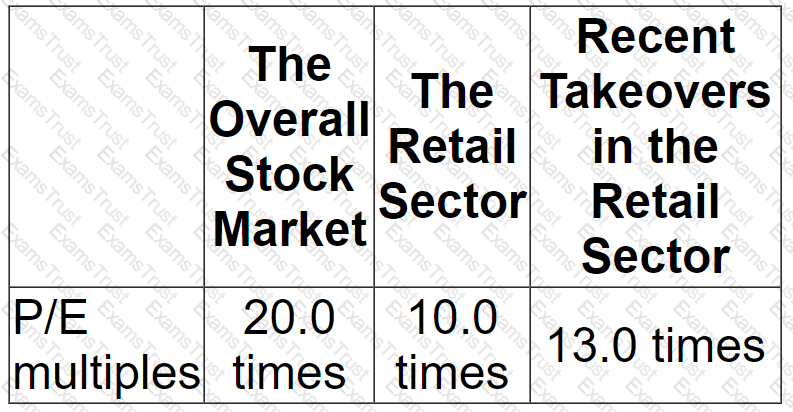

Listed company R is in the process of making a cash offer for the equity of unlisted company S.

Company R has a market capitalisation of $200 million and a price/earnings ratio of 10.

Company S has a market capitalisation of $50 million and earnings of $7 million.

Company R intends to offer $60 million and expects to be able to realise synergistic benefits of $20 million by combining the two businesses. This estimate excludes the estimated $8 million cost of integrating the two businesses.

Which of the following figures need to be used when calculating the value of the combined entity in $ millions?

A national rail operating company has made an offer to acquire a smaller competitor.

Which of the following pieces of information would be of most concern to the competition authorities?

Company R is a well-established, unlisted, road freight company.

In recent years R has come under pressure to improve its customer service and has had some cusses in doing this However, the cost of improved service levels has resulted In it marketing small losses in its latest financial year. This is the forest time R has not been profitable.

R uses a’ residual divided policy ad has paid dividends twice in the last 10 years.

Which of the following methods would be most appropriate for valuating R?

A company based in Country A with the A$ as its functional currency requires A$500 million 20-year debt finance to finance a long-term investment The company has a high credit rating, but has not previously issued corporate bonds which are listed on the stock exchange Which THREE of the following are advantages of issuing 20 year bonds compared with simply borrowing for a 20 year period?

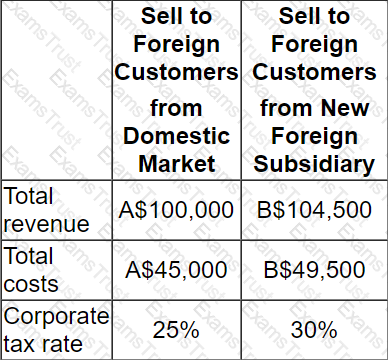

A company is considering either directly exporting its product to customers in a foreign country or setting up a subsidiary in the foreign country to manufacture and supply customers in that country.

Details of each alternative method of supplying the foreign market are as follows:

There is an import tax on product entering the foreign country of 10% of sales value.

This import duty is a tax-allowable deduction in the company's domestic country.

The exchange rate is A$1.00 = B$1.10

Which alternative yields the highest total profit after taxation?

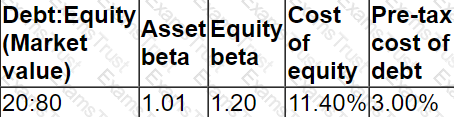

The following information relates to Company A's current capital structure:

Company A is considering a change in the capital structure that will increase gearing to 30:70 (Debt:Equity).

The risk -free rate is 3% and the return on the market portfolio is expected to be 10%.

The rate of corporate tax is 25%

Using the Capital Asset Pricing Model, calculate the cost of equity resulting from the proposed change to the capital structure.

Company P is a large unlisted food-processing company.

Its current profit before interest and taxation is $4 million, which it expects to be maintainable in the future.

It has a $10 million long-term loan on which it pays interest of 10%.

Corporate tax is paid at the rate of 20%.

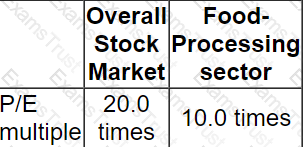

The following information on P/E multiples is available:

Which of the following is the best indication of the equity value of Company P?

A large, listed company in the food and household goods industry needs to raise $50 million for a period of up to 6 months.

It has an excellent credit rating and there is almost no risk of the company defaulting on the borrowings. The company already has a commercial paper programme in place and has a good relationship with its bank.

Which of the following is likely to be the most cost effective method of borrowing the money?

A company is funded by:

• $40 million of debt (market value)

• $60 million of equity (market value)

The company plans to:

• Issue a bond and use the funds raised to buy back shares at their current market value.

• Structure the deal so that the market value of debt becomes equal to the market value of equity.

According to Modigliani and Miller's theory with tax and assuming a corporate income tax rate of 20%, this plan would:

A company has stable earnings of S2 million and its shares are currently trading on a price earnings multiple {PIE) of 10 times. It has10 million shares in issue.

The company is raising S4 million debt finance to fund an expansion of its existing business which is forecast to increase annual earnings straight away by 25% and then remain at that level for the foreseeable future. The corporation tax rate is 20%. It is expected that the P/E will reduce to 8 times over the next year.

What is the most likely change in shareholder wealth resulting from this plan?

A large, listed company in the food and household goods industry needs to raise $50 million for a period of up to 6 months.

It has an excellent credit rating and there is almost no risk of the company defaulting on the borrowings. The company already has a commercial paper programme in place and has a good relationship with its bank.

Which of the following is likely to be the most cost effective method of borrowing the money?

A company is planning a new share issue.

The funds raised will be used to repay debt on which it is currently paying a high interest rate.

Operating profit and dividends are expected to remain unchanged in the near future.

If the share issue is implemented, which THREE of the following are most likely to increase?

A company plans to raise S15 million to finance an expansion project using a rights issue Relevant data

• Shares will be offered at a 20% discount to the present market price of S12 50 per share

• There are currently 3 million shares in issue

• The project is forecast to yield a positive NPV of $9 million

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?

Company A plans to acquire Company B.

Both firms operate as wholesalers in the fashion industry, supplying a wide range of ladies' clothing shops.

Company A sources mainly from the UK, Company B imports most of its supplies from low-income overseas countries.

Significant synergies are expected in management costs and warehousing, and in economies of bulk purchasing.

Which of the following is likely to be the single most important issue facing Company A in post-merger integration?

A company is currently all-equity financed.

The directors are planning to raise long term debt to finance a new project.

The debt:equity ratio after the bond issue would be 30:60 based on estimated market values.

According to Modigliani and Miller's Theory of Capital Structure without tax, the company's cost of equity would:

Integrated reporting is designed to make visible the capitals on which the organisation depends, and how the organisation uses those capitals to create value in the short, medium and long term

Which THREE of the following capitals are specifically identified in the Integrated Reporting

A company needs to raise $20 million to finance a project.

It has decided on a rights issue at a discount of 20% to its current market share price.

There are currently 20 million shares in issue with a nominal value of $1 and a market price of $5 per share.

Calculate the terms of the rights issue.

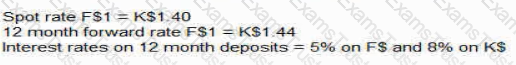

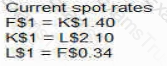

Which TWO of the following situations offer arbitrage opportunities?

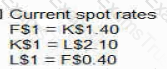

A)

B)

C)

D)

G purchased a put option that grants the right to cap the interest on a loan at 10.0%. Simultaneously, G sold a call option that grants the holder the benefits of any decrease if interest rates fall below 8.5%.

Which THREE possible explanations would be consistent with G's behavior?

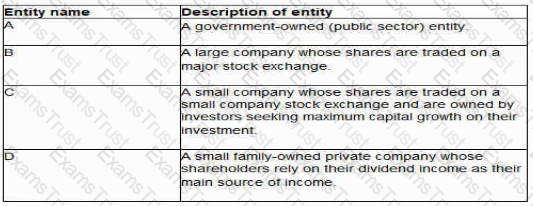

The directors of the following four entities have been discussing dividend policy:

Which of these four entities is most likely to have a residual dividend policy?

A venture capitalist invests in a company by means of buying:

• 9 million shares for $2 a share and

• 8% bonds with a nominal value of $2 million, repayable at par in 3 years' time.

The venture capitalist expects a return on the equity portion of the investment of at least 20% a year on a compound basis over the first 3 years of the investment.

The company has 10 million shares in issue.

What is the minimum total equity value for the company in 3 years' time required to satisify the venture capitalist's expected return?

Give your answer to the nearest $ million.

$ million.

An all equity financed company reported earnings for the year ending 31 December 20X1 of $5 million.

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 7%.

The company pays corporate income tax at 30%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

Company P is a pharmaceutical company listed on an alternative investment market.

The company is developing a new drug which it hopes to market in approximately six years' time.

Company P is owned and managed by a group of doctors who wish to retain control of the company. The company operates from leased laboratories with minimal fixed assets.

Its value comes from the quality of its research staff and their research.

The company currently has one approved drug which generates sufficient cashflow to cover day to day operations but not sufficient for major new research and development.

Company P wish to raise debt finance to develop the new drug.

Recommend which of the following types of debt finance would be most appropriate for Company P to help finance the development of this new drug.

Company A has agreed to buy all the share capital of Company B.

The Board of Directors of Company A believes that the post-acquisition value of the expanded business can be computed using the "boot-strapping" concept.

Which of the following most accurately describes "boot-strapping" in this context?

A private company manufactures goods for export, the goods are priced in foreign currency B$.

The company is partly owned by members of the founding family and partly by a venture capitalist who is helping to grow the business rapidly in preparation for a planned listing in three years' time.

The company therefore has significant long term exposure to the B$.

This exposure is hedged up to 24 months into the future based on highly probable forecast future revenue streams.

The company does not apply hedge accounting and this has led to high volatility in reported earnings.

Which of the following best explains why external consultants have recently advised the company to apply hedge accounting?

A company has:

• A price/earnings (P/E) ratio of 10.

• Earnings of $10 million.

• A market equity value of $100 million.

The directors forecast that the company's P/E ratio will fall to 8 and earnings fall to $9 million.

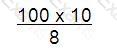

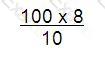

Which of the following calculations gives the best estimate of new company equity value in $ million following such a change?

A)

B)

C)

D)

Company C is a listed company. It is currently considering the acquisition of Company D. The original founder of Company C currently owns 52% of the shares.

Alternative forms of consideration for Company D being considered are as follows:

• Cash payment, financed by new borrowing

• issue of new shares in Company C

Which of the following is an advantage of a cash offer over a share-for exchange from the viewpoint of the original founder of Company C?

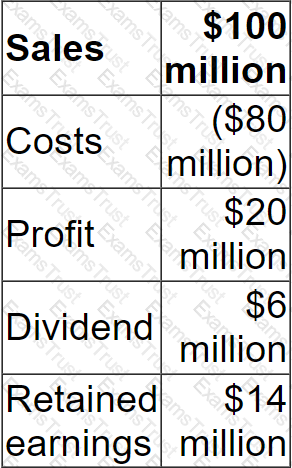

A company's main objective is to achieve an average growth in dividends of 10% a year.

In the most recent financial year:

Sales are expected to grow at 8% a year over the next 5 years.

Costs are expected to grow at 5% a year over the next 5 years.

What is the minimum dividend payout ratio in 5 years' time that would allow the company to achieve its objective?

A company has borrowings of S5 million on which it pays interest at 8%. It has an operating profit margin of 20%.

The company plans to increase borrowings by S2 million Interest on additional borrowings would be 10% and the operating profit margin would remain unchanged

A debt covenant attached to the new borrowings requires interest cover to be at least 4 times throughout the period of the borrowing

Interest cover is defined in the loan documentation as being based on operating profit

What is the minimum sales value required each year to avoid a breach of the interest cover covenant'

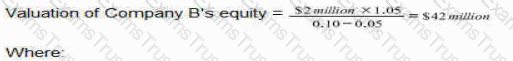

Listed Company A has prepared a valuation of an unlisted company. Company B. to achieve vertical integration Company A is intending to acquire a controlling interest in the equity of Company B and therefore wants to value only the equity of Company B.

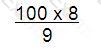

The assistant accountant of Company A has prepared the following valuation of Company B's equity using the dividend valuation model (DVM):

Where:

• S2 million is Company B's most recent dividend

• 5% is Company B's average dividend growth rate over the last 5 years

• 10% is a cost of equity calculated using the capital asset pricing model (CAPM), based on the industry average beta factor

Which THREE of the following are valid criticisms of the valuation of Company B's equity prepared by the assistant accountant?

The directors of a financial services company need to calculate a valuation of their company’s equity in preparation for an upcoming initial Public Offering (IPO) of shares. At a recent board meeting they discussed the various methods of business valuation.

The Chief Executive suggested using a Price-earing (P./E) method of valuation, but the finance Director argued that a valuation based on forecast cash flows to equity would be more appropriate.

Which THREE of the following are advantages of valuation based on forecast cash flows to equity, compared to a valuating using a price earnings methods?

A company has undertaken a transaction with its shareholders which has had the following impact on its financial statements:

• Retained earnings has decreased

• Share capital has increased

• Earnings per share has decreased

• The book value of equity is unchanged

The company has undertaken a: