When a payer receives a “B” Notice, it must send a copy of the notification to the payee within:

Which of the following criteria is NOT used to determine if the worker is a nonresident for U.S. income tax purposes?

An employee has $240,000.00 in YTD taxable wages and receives a taxable fringe benefit of $2,500.00. Calculate the Medicare and FITW using the optional flat rate method for the taxable fringe benefit.

Employer's federal quarterly employment taxes are reported on:

Employee privacy rights are NOT governed by:

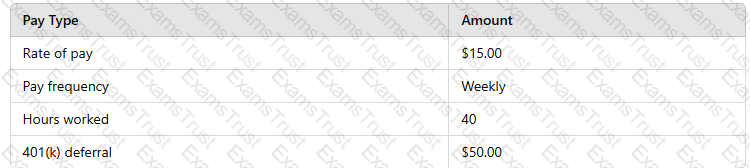

Under theCCPA, use the following information to calculate theMAXIMUMdeduction for the child support order for an employee whois not supporting another family and not in arrears.

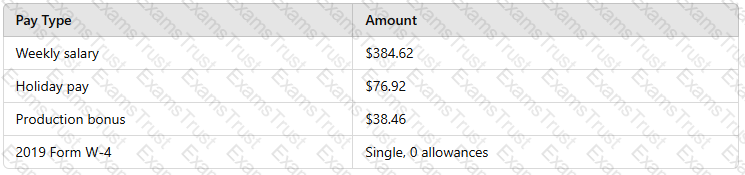

Using the wage bracket method, calculate the employee’s net pay. The employee’s W-4 was completed in 2019 or earlier.

When resolving late deposits, the payroll staff should take all of the following steps EXCEPT:

The journal is commonly referred to as the record of:

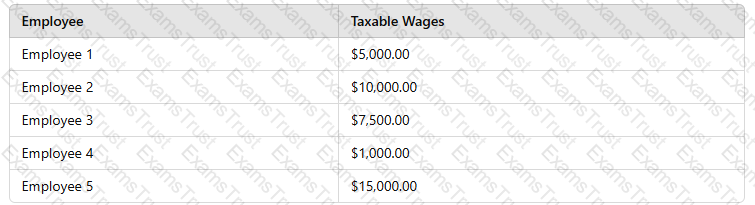

Using the table of taxable wages below, calculate the employer'sFICA tax liabilityon the first check of the year:

Which activity does NOT indicate a data breach has occurred?

When providing wage data for a workers’ compensation audit, which of the following wage types would be included as compensation?

On June 1st, the Payroll Department received an SUI rate change notice indicating a new rate effective January 1st of the current year. The system was not updated with the new rate until October 1st. SUI contribution recalculation will need to be done for:

Using the percentage method for automated payroll systems, calculate the federal income tax withholding based on the following information:

Proper documentation of policies and procedures ensures:

Using the following information, calculate theFUTA tax liability:

Which of the following considerations is NOT needed when implementing ashared services environment?

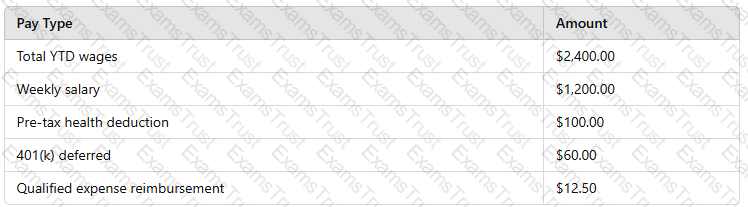

Using the following information, calculate the employer's total FICA tax liability for the first payroll of the year.

The FLSA requires employers to retain employee work time schedules for at least:

Workers’ compensation payments are excluded from gross income and employment taxes EXCEPT when the amounts received:

What information is reported to the IRS on Form 1094-C?

The employer’s unpaid portion of payroll taxes is posted as a credit to a(n):

All of the following elements are part of the control process EXCEPT:

Using the following information from a payroll register, calculate the tax deposit liability for the payroll.

All of the following workflow mapping descriptions are correct EXCEPT:

All of the following plans are deferred compensation plans EXCEPT:

The purpose of grossing-up an amount to an employee is to:

Report backup withholding to the IRS using:

Payroll liability tax accounts should be reconciled at LEAST once a:

What is the purpose of Form I-9?

An employee clocked in for work at 8:07 a.m. and out at 4:08 p.m. According to the DOL policy on rounding work hours, which of the following recorded hours are CORRECT?

Which of the following statements about payments made under workers' compensation benefits is FALSE?

To optimize customer service, policies should include attributes which are:

Which of the following wage attachments has the highest priority for withholding?

All of the following activities are examples of an internal control EXCEPT:

The FIRST action an employer should take when a natural disaster occurs is:

An upgrade to a payroll system can impact all of the following documentation within the payroll department EXCEPT:

Under the rules of constructive receipt, the employee is considered paid:

A company has engaged an individual to write a sales contract. The individual receives a flat amount for the task and has an assigned time frame for completion. This individual is classified as a(n):

Which of the following simulations would NOT be performed when testing a disaster recovery plan?

An employee has YTD wages in the amount of $250,000.00 and receives a $1,753.00 bonus payment. Using the optional flat rate method, calculate the federal income tax withholding from the bonus payment.

The best practice is to start the annual reconciliation after the:

All of the following criteria are used to determine FMLA eligibility EXCEPT the number of: