Cash management services commonly used outside the United States include which of the following?

I. Interest-bearing deposit accounts

II. Controlled disbursement systems

III. Pooling of bank accounts

The process by which a bank or insurance company guarantees the debt obligation of a borrower is referred to as credit:

The renegotiation of trade payment terms in an e-commerce environment should include which of the following?

Which of the following clears international checks?

Which of the following can be used for monitoring accounts receivables?

I. Aging schedule

II. Credit terms

III. Days' sales outstanding

IV. Receivables balance pattern

The credit risk in the settlement of a Fedwire is borne by the:

Examples of traditional factors used in making a credit decision include which of the following?

I. Capacity

II. Capital

III. Compliance

IV. Character

Which of the following will exempt commercial paper from SEC registration?

I. A maturity of fewer than 270 days

II. A rating grade of A-1 or P-1

III. Distribution through a licensed dealer

IV. Backing by a U.S. bank letter of credit

The time between the payor's mailing of a check and the payee's receipt of usable funds is known as:

Which of the following is a common method for assigning float on a check deposited to a non-US bank account?

Which of the following statements is true about threshold concentration?

Components of a field banking system include which of the following?

I. Local bank

II. Concentration bank

III. Lockbox bank

On a statement of cash flow, which of the following items are considered sources of cash?

I. Increase in short-term investments

II. Net income

III. Increase in accounts payable

IV. Decrease in long-term debt

The term "collection float" is defined as the delay between the time the payor:

A lockbox system is characterized by which of the following?

A currency is said to trade at a discount if it is worth:

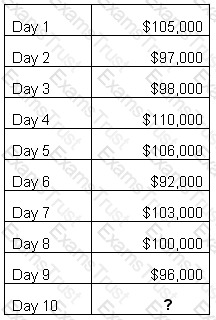

The treasury analyst for XYZ Corporation, a small retailer, is trying to forecast daily cash receipts being swept from the store depository accounts. The analyst has been given the data in the table regarding receipts from the last few days. The analyst chooses to use a seven-day simple moving average forecast methodology.

What is the amount that XYZ Corp. would expect to receive on Day 10 (rounded to the nearest whole $)?

A manufacturing company is working to improve its cash conversion cycle. Factory production has increased over the last year to increase inventory levels. They have an inventory turnover of 3.1 and asset turnover of 5.0. The company has a days’ payable of 30 and a days’ receivable of 60. It has started enforcing its net 30 terms and placed customers with balances outstanding more than 45 days on credit hold. As a result, the company collected receivables quicker but it suffered a 10% loss in sales. What can the company do to reduce its cash conversion cycle?

Company XYZ sends an ACH debit file valued at $300,000 with an average item value of $1,000. The file settlement date is March 10. The file contains no duplicate items and items are split equally between corporate and consumer items. One percent of consumer items and 2% of corporate items were returned. What would be the final net settlement value for Company XYZ?

Which of the following types of payments would NOT be included in cash flow forecasting?

Company RST is a seasonal retailer who has just completed its holiday season and is temporarily flush with cash. The treasurer has identified approximately $15 million of excess balances and is trying to determine what to do with the surplus cash. Cash forecasts show that the funds will be needed in approximately 30 days to replenish inventory. Which of the following plans should the treasurer implement immediately?

XYZ Company is considering different methods of concentrating cash from its subsidiary accounts to its main operating account. It uses short-term borrowings with a rate of 7% to fund daily operations, and the reserve adjusted earnings credit rate on its subsidiary accounts is 1%. A review of its bank fees shows that wires (same day transfer) cost the XYZ Co. $7.00 each while ACH debits (next day transfer) cost $1.25 each. If the primary objective is to minimize costs, what must the transfer amount be (rounded to the nearest whole $) to justify the use of a wire transfer instead of an ACH to concentrate the funds?

All of the following factors influence a company's decision to use electronic commerce EXCEPT:

The earnings allowance rate applied to collected balances is usually determined by which of the following rates?

Which of the following can be exercised only on the expiration date?

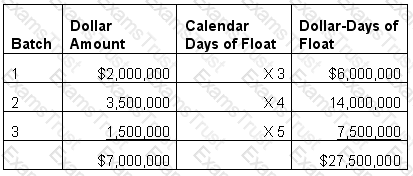

There are 31 calendar days in the month, and the opportunity cost of funds is 9%.

What is the annual cost of float for the batches listed?

A company purchases a machine tool with an expected life of 3 years. Under the accrual accounting method, the equipment would be treated in which of the following ways?

A merchant presents 2 different batches of credit card transactions for processing, each batch has the same dollar value and number of transactions, but the fees are different. Which of the following explains why?

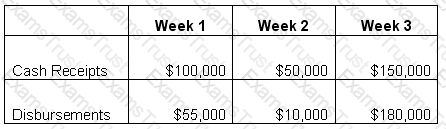

A company has a beginning cash balance of $50,000. Its weekly cash flow forecast shows the following information for the next three weeks.

Which of the following statements is true?

The relationship between debt and equity in a company's capital structure is called:

A sinking fund is primarily used for which of the following purposes?

An assistant treasurer discovers that the CFO has been allowing other executives to exercise stock options during blackout periods. What will prevent the assistant treasurer from losing his/her job if he/she reports this discovery?

Company ABC is experiencing an increase in bank fees due to its new international customers paying by check. Nearly 15% of all deposited items are international checks. Twenty percent of the company’s checks have 1 day of float. Sixty-five percent of the company’s checks are on-us items. The company has $300,000 of deposits each day. The company’s deposits consist of both cash and checks, split evenly. On a typical day, how much of the deposit will be available immediately?

Which institution or accord was approved in 2009 to strengthen the regulatory capital framework for banks by focusing on minimum capital requirements, supervisory review and market discipline?

Company X has asked its banking partner for a recommendation on which type of bank account would be best if it has excess funds that are not required for daily cash management. The company determined the excess cash flows by using the short-term cash forecasting distribution method. Company X will require a return on these funds. Which account is recommended?

A treasury manager has $5 million that is not needed for 6 months. The treasury manager has decided to invest the funds in a liquid instrument, using the current portion of a 5-year AA rated corporate bond that is subject to U.S. Securities and Exchange Commission (SEC) regulations. In what market would the treasury manager purchase this investment?

A publicly held U.S. company has reported at the beginning of the year that it expects to increase shareholder value by 5%. The current expectations are for interest rates to remain steady with a decline in fourth quarter. Treasury policy requires that investments be 90 days or less and investment grade. How should the company invest excess cash to support this goal?

Company A has decided to purchase $3,000,000 of real estate from Company B. Company A will make the payment in 3 parts. The electronic payments will be sent from Bank A to Bank B. On Day 1 Company A will send a $400,000 check as a deposit, which is deductible from the balance. The check is expected to clear in 4 days. On Day 2, two payments are initiated, one wire transfer for $2,000,000 and an ACH for $600,000 to complete the balance. On Day 2 what percentage of the payment to Company B is NOT final?

A portfolio manager would like to purchase U.S. 50 million of 10-year notes 3 months from now, but has heard news that the Federal Reserve will start a purchasing program of longer term treasuries that will include 10-year notes. The purchase program would likely cause a lowering of market interest rates. The manager would also like to avoid having to use margin on a daily basis. To remove the price risk that may be associated with the Federal Reserve purchasing program, the portfolio manager would MOST LIKELY enter into an:

XYZ Corporation uses ABC Bank for their lending and treasury management. In addition, the bank serves as bond trustee for XYZ Corp. If XYZ Corp. becomes distressed, this relationship could create a conflict of interest for the financial institution. What barrier prevents a financial institution from sharing confidential information between divisions?

MCA, Inc. upgraded the Treasury workstation that had been in place for two years and used data from that 24-month period to develop a new short-term forecast. A trend factor was applied to controlled disbursements of 97% on a month-by-month basis and the variance to actual disbursements is less than 1%. Which of the following model validation techniques was utilized?

Company XYZ is a manufacturer of industrial equipment and has enjoyed a large percentage increase in profits from a small increase in revenues. Sales recently plummeted resulting in steep decline in profitability. Which of the following BEST describes the cost structure of the company?

ABC Company’s Treasury department outsourced its overnight investment duties to XYZ Money Management. XYZ placed the funds received from ABC into corporate commercial paper, which has recently gone into default after numerous ratings downgrades. The investment policy of ABC Company states that all investments must be in investment grade commercial paper; however, the agreement gives XYZ the ability to make exceptions with the approval of the Treasurer of ABC Company. The Treasurer was never notified of the ratings downgrades. What role or responsibility, if any, was violated with regards to the investment policy?

The Treasury Manager of a chain of department stores wants to develop a medium-term forecast. Management plans to open two new stores, and anticipates same-store sales to increase by 15%. Which of the following items can be predicted with the highest degree of certainty?

The Treasury Analyst at an investment firm has entered the company into a repurchase agreement with a counterparty at the direction of the Treasury Manager. The compliance office has determined that the trade was done in violation of the company investment policy. The Treasury Manager has the power to approve the execution of trades; however, the Treasury Analyst was not a designated trader on behalf of the firm. Which area of the investment policy was violated by the Treasury Analyst?

Which of the following capital budgeting methods ignores the time value of money?

Why would a company establish a short-term credit facility?

A U.S. company wants to increase its cash turnover rate. It is finding that customers are not taking the offered discount terms of 3/15, net 35. What action might the company take in order to achieve its goal?

Which of the following is considered an important factor when selecting a financial service provider?

Determining that payments are made to vendors and suppliers based on credit terms is the responsibility of:

A cash manager is responsible for a small subsidiary that has significant funds but only writes one check per month. Which of the following types of accounts would the cash manager use for this subsidiary?

A multidivisional domestic company with centralized treasury decision-making can potentially utilize intra-company lending to:

Which of the following is a regulation that is having a major impact on the treasury profession?

A company that has facilities in different states and wants to control funding and facilitate check cashing would use which of the following?

All of the following bank products and services can simplify the preparation of the daily cash position EXCEPT:

ABC company has a significant number of customers who are mainly consumers making monthly installment payments. Which one of the following types of lockbox would be the MOST appropriate for ABC to use?

Which of the following institutions would be regulated by the Office of the Comptroller of the Currency (OCC)?

In the event of bankruptcy and the subsequent liquidation of issuer's debt, in what order, from first to last, will the following be repaid?

1. Senior secured debt

2. Senior subordinated debt

3. Junior secured debt

4. Junior debentures

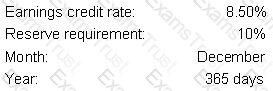

On the basis of the information above, what level of net collected balances is necessary to compensate a bank for $1.00 worth of services?

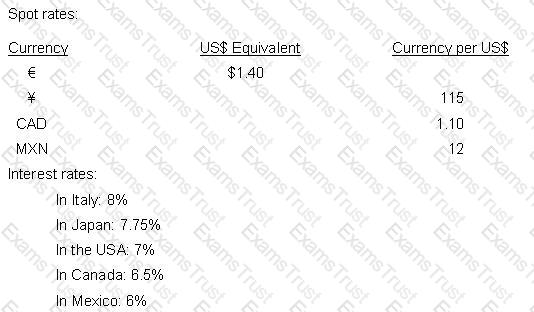

Which currency will sell at the greatest discount in the forward market against the U.S. dollar?

Which of the following is NOT a component of the operating cycle?

A firm’s air conditioning unit breaks down unexpectedly and must be replaced immediately. What type of liquidity requirement is this an example of?

One reason for charging management fees to subsidiaries is to:

Which of the following would MOST directly affect a company’s dividend policy?

Which of the following can be related to a company’s stock price?

Fluctuations in interest rates and the availability of funds are more significant risks for companies that rely on:

In terms of targeting a company’s capital structure, when is it beneficial to assume a high level of financial risk?

Which scenario provides the BEST example of an agency problem?

In a partial reconciliation, a bank provides a company with which of the following?

Which of the following is an example of a typical passive investment strategy?

The Treasurer of a publicly-traded U.S. company discovers several large payments which were made from the company’s disbursement account without proper approval. These unauthorized payments represent an exposure to penalties imposed by which regulator?

Which one of the following is NOT a method used by a company to repurchase stock?

What is the primary weakness of a risk management policy that includes risk control without specifically providing a plan for risk financing?

Which of the following is the MOST accurate statement regarding the passage of the Sarbanes-Oxley Act?

A publicly-traded U.S. company has a German subsidiary which has accumulated significant cash balances. The company needs to pay its quarterly dividend but lacks the funds to make the payment. What is its BEST alternative for obtaining the funds?

An organization must maintain adequate liquidity to meet:

Which of the following concentration transfer alternatives provide the fastest availability of funds?

Treasury policies and procedures should outline roles and responsibilities for which of the following activities?

As a result of an employee's intentional actions, an electronic payment to a supplier was misdirected to an unauthorized account. This is an example of which of the following types of risk?

A U.S. exporter has agreed to export goods to a Canadian buyer with net 30 payment terms due in Canadian dollars. What type of risk is the exporter exposed to?

Which agency appoints the chairman and members of the Public Company Accounting Oversight Board?

Capital budgeting decisions are most commonly evaluated in terms of:

Check MICR line information includes which of the following?

I. Bank of deposit identification number

II. Payee bank identification number

III. Federal Reserve bank code

IV. Payor's account number

ABC Company is a net borrower with a weighted average cost of capital of 11.5%. What kind of bank fee arrangement is it likely to prefer?

All of the following are objectives of credit management EXCEPT:

Which of the following activities creates administrative costs associated with a concentration system?

When a company must determine the optimal mix of long-term borrowings versus common equity, it is making which of the following types of corporate financial decisions?

The amount of the discount required to renegotiate credit terms in EDI depends on which two of the following?

I. Present value impact of the timing change

II. Credit risks involved

III. Revolving credit agreements

IV. Transaction costs savings

A measure of the incremental impact of a company's investments on market capitalization is known as:

Which of the following are reasons for companies to use controlled disbursement?

I. To obtain timely check presentment information

II. To enhance supplier relationships

III. To increase their available cash

IV. To improve their overall creditworthiness

Which of the following credit terms would be MOST appropriate for a seasonal product that a manufacturer wants to sell to a retailer during the product's off-season?

Operational risk is defined as the risk of direct or indirect losses resulting from external events or failure of internal resources. As treasury departments maintain legacy systems that must be integrated into more complex technology, one would expect that:

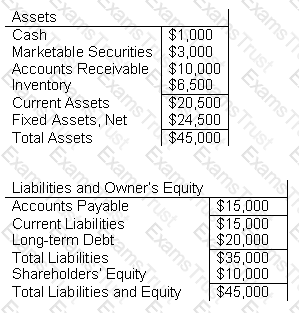

The following information about a company is at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%. The company's current ratio is:

The analysis of a company launching an initial public offering includes disclosure of information that may interest investors. It also includes confirmation that financial statements reflect true value under GAAP and other pertinent areas of a company’s operations. What is this analysis known as?

Which of the following services allows a bank to match checks presented for payment against company check issuance data?

BF Company, a manufacturer of food products, reported financial information shown in the Exhibit for the end of the year. BF Company is subject to covenants in its commercial paper program. It is in compliance with which of the following?

An analyst for a landscaping company wants to adjust her cash-flow forecast to account for the seasonality of outflows. How can this be accomplished?

The treasury management department of a company hires a consulting firm to provide research on how other companies in the industry have structured their treasury operations. This is an example of which practice?

During the 1970s, many companies instituted dividend reinvestment plans (DRIPS). There are many benefits of this plan. What is the one negative aspect?

A real estate development company has excess cash that it would like to invest in one of its properties:

In which property should the company invest?

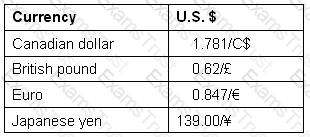

On the basis of the following exchange rates,

which of the following currency amounts has the greatest value in U.S. dollars?

A telecommunications company receives a profit of $587,542 from its cellular phone production unit in the year after investing $962,870 in a new product line. What is the first year return on its original investment?

Which one of the following ties a user’s private key to a user’s public key?

The Federal Reserve can increase the money supply by:

A lender is evaluating the creditworthiness of a company that has high levels of operating leverage. In determining the debt capacity of the company, the bank would MOST LIKELY prefer a:

A company transmits a payment file of ACH and Fedwire vendor payments to its financial institution to execute. Which article of the Uniform Commercial Code governs these payments?

A French company conducts business strictly within the euro zone (the EMU). Which type of risk is of LEAST concern?

Financing decisions in a budget are used to construct all of the following pro forma financial statement components EXCEPT:

ABC Company is a national retail company and uses XYZ Bank for its collections and payroll services. XYZ has recently experienced financial problems; what is the greatest risk to ABC Company?

A call option for a company has an exercise price of $50. The stock is currently trading at $60. At maturity, what should an investor who paid $3 for the option do?

An arrangement in which a borrower makes periodic payments to a separate custodial account that is used to repay debt is known as a:

Which of the following is NOT a short-term cash forecasting technique?

A small regional bank is losing market share in fiduciary services and the CEO has decided to scale back the trust department. Which of the following is considered a core service of a trust department?

ABC Corporation receives images of paid check exception items from its bank and reviews them daily. What action should be taken on an item where the payee on the image does NOT match the data from ABC Corporation's accounts payable?

A small for-profit, start-up company is designing a retirement plan with the goal of minimizing costs and operating income volatility while providing a qualified retirement savings vehicle. Which of the following would be the BEST choice?

A company is evaluating its employee healthcare expense and payroll applications. If the company wishes to provide maximum convenience to its employees, which payment method is the BEST choice?

Which of the following is a tool that companies use to obtain a quantitative rating of a financial institution’s level of service?

Which of the following would be considered insurance risk management services?

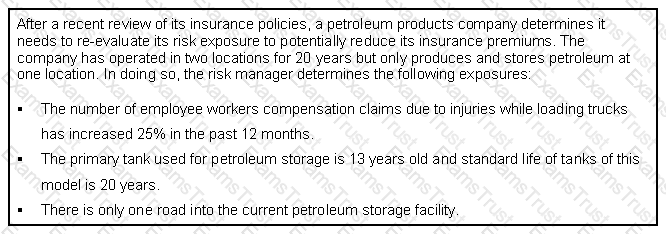

Given the above information,

if the risk manager adds a tank at its second facility, what loss control technique is being used?

A U.S. company has a secured committed line of credit of $5 million. The company successfully transmitted a $5.5 million wire transfer instruction out to the bank. The bank contacted the company and informed it that the wire transfer would not be processed. What is the MOST LIKELY reason the bank gave the company?

Private companies usually go public by making an initial public offering. What is the term for offering subsequent shares in the market?

A company is filing for bankruptcy protection and is concerned about the welfare of its sizeable retiree population. Under ERISA, it is obligated to perform which of the following actions regarding its defined benefit plan?

What is the premium (price) for an oil contract, if the following conditions are present?

LIBOR rate of 5%

Out of the money cost of $3

Strike price is $4

In the money price of $1

Speculative premium of $2

Based on the above information,

if the company uses the trade-off theory in considering its WACC, how will it finance its growth?

EDI infrastructure includes which of the following four PRIMARY components?

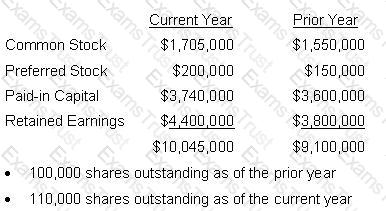

Equity section of Fisher, Inc. Financial Statement

If an investor paid $1,400.00 (excluding fees) for 75 shares of common stock, what was the market value of Fisher, Inc. at the time of purchase?

Securities sold by companies in an initial public offering (IPO) arE.

A company with high operating leverage reduces its average cost per unit by 20% as its sales volume increases by 40% annually. This an example oF.

A company enters into a cash flow hedge to offset fluctuations in the value of foreign currency transactions occurring in two years. How should the company record the gains and/or losses on the cash flow hedge in the current year?

A multinational company owns a United Kingdom subsidiary that has total assets equal to £1 million and intercompany loans due to the parent company equal to $1 million. It would like to undertake a balance sheet hedge of the U.K. subsidiary’s GBP liability because it expects a depreciation of the pound. Given these circumstances, which of the following actions would be appropriate?

Two critical factors in determining an operational risk management strategy for a company are:

Underfunded pension obligations can be reduced by:

Which of the following is a KEY operational advantage of short-term debt?

The exchange of a fixed interest rate cash flow for a floating interest rate cash flow with both interest rates in the same currency is an example of:

A treasurer is monitoring the yield curve through a service provider (like Reuters) and notices that it is moving from downward sloping to upward sloping. Based on this information, the treasurer should consider:

A company invests all of its short-term excess cash in T-bills on a daily basis. To prevent delays in processing its outgoing wire transfers, the company may ask its cash management bank to establish a:

Which of the following is true when a company purchases goods using trade credit from suppliers?

An employer wishing to reduce operating income volatility would MOST LIKELY offer what type of retirement option to its employees?

For a retirement plan to be qualified under ERISA, employer and employee contributions must be: