Initial issue expense in respect of the scheme should not exceed ______ of the funds raised during that scheme

The basic principles of Islamic Finance are…..

A client has a minor child she is concerned about what might happen if she was to die while the child was still young and unable to sensibly handle a sizeable in heritance one solution could be to draft her will so that the child receives the asset once reaching age 21 this is an example of

What is the minimum age required to avail the Benefits provided under the golden hand shake scheme?

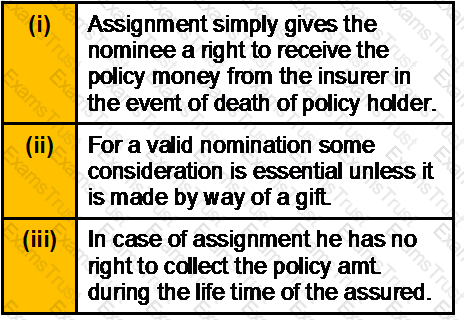

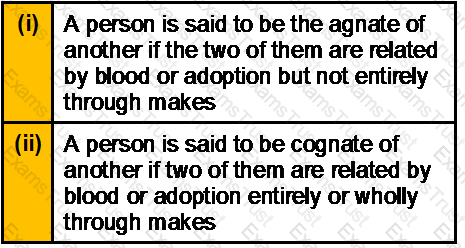

Which one of the following is/are correct?

Mr. Hitesh Shah has a portfolio with 23 different equities. The portfolio increased by 20% and has a beta of 1.50. Utilizing the Capital Asset Pricing Model, compute by what percent the market changed (round to nearest 0.5%) (Assume risk free rate of 5%)?

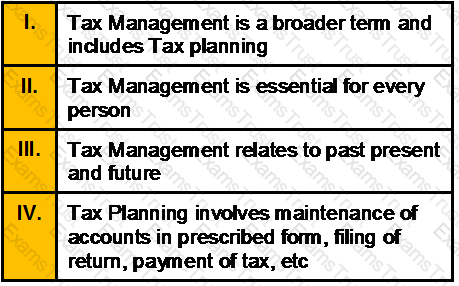

Which of the following statement is/are correct?

Actual Loss ratio is

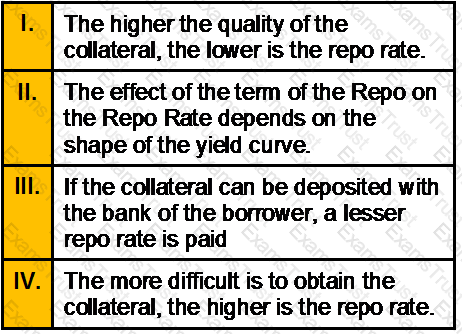

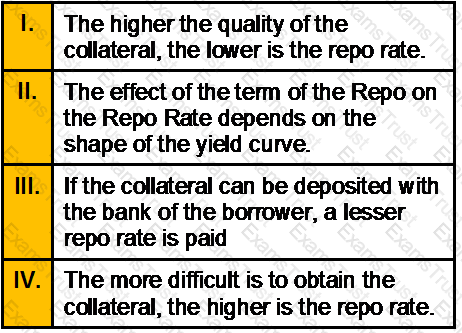

Which of the following statements in reference to REPO Rate is/are correct?

Under the Workmen Compensation Policy, when the employment injury results in death, the insurance company pays 40 % of the monthly wages of the deceased multiplied by the relevant factor or Rs. _________ whichever is more.

Suresh a 30 years old person has joined ABHG on 1/07/2006. His monthly salary (net salary) after deduction is payable Rs. 20500.His monthly expenses details are as follows:

Assume that Suresh has taken his flat on rent from 01/07/2006. On 01 /07/2006 he has cash in hand Rs. 2450. What will be his cash in hand on 31/03/2007.

How much should one deposit today in a bank account paying interest compounded quarterly if you wish to have Rs. 10000 at the end of 3 months, if the bank pays 5% annually?

International credit cards can be used by Indians for _________.

Which of the following statement is true?

Under a Personal Accident policy Mr. Ajay has taken, what percentage of sum assured he can get if he losses his one eye and one limb in an accident and under which type of benefit?

Negative amortization leads to ______________

Mr. M by a Gift deed transferred certain property to her daughter, with a direction that daughter should pay an annuity to Mr. M's brother, as had been done by Mr. M. On the same day, the daughter executed a deed in writing in favour of Mr. M's brother, agreeing to pay annuity. Afterwards, she declined to fulfil her promise saying that no consideration had moved from her uncle. Which of the following statements is correct'?

Mr. Sahil has two daughters and is in receipt of education allowance of Rs 200pm for each of them. What would be the taxable allowance in the hands of Mr. Sahil for the full FY.

Expenses are 10% of the gross (office) premium. Pure premium is Rs. 200. Calculate office premium.

Ram born in 1950 has a life expectancy at birth of 65 years. Sita his wife born in 1955 has a life expectancy at birth of 70 years. Assuming that the life expectancies have not changed. Ram is planning to buy an annuity to be paid to him or his wife till anyone of them is alive. Assuming Ram will retire on attaining age 58 i.e. in 2008, what should be the time period of the annuity?

Calculate the premium for a policy of Rs. 10 lacs, if on an average out of 50000 persons aged 39,572 people die every year

A project should be considered if the Profitability Index is

Compulsory audit of account is required u/s 44AB of IT, if the total sales/ turnover exceed _______

Yash pays health insurance premiums for himself, his wife and his two children aged 13 and 8. Premiums for which of these individuals will qualify as deductible from Yash’s taxable income?

Purpose of budget is ____________

The first Mutual fund to offer Sarahia complaint fund IS

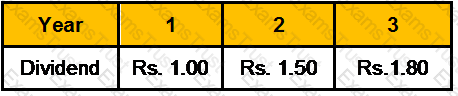

You bought a stock for Rs. 28.29 that paid the following dividends

After the third year, you sold the stock for Rs. 35. What was the annual rate of return?

A central bank sale of ________ to purchase ________ in the foreign exchange market results in an equal rise in its international reserves and the monetary base.

The government regulates financial markets for three main reasons:

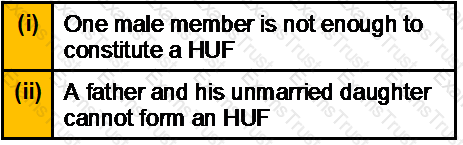

Which one of the following statements is/are correct?

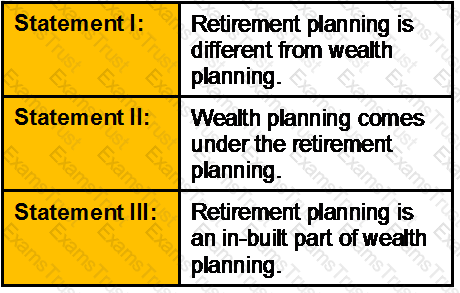

Retiring early will ____________ the accumulation phase while ____________ the retirement phase

Which of the following statements are correct?

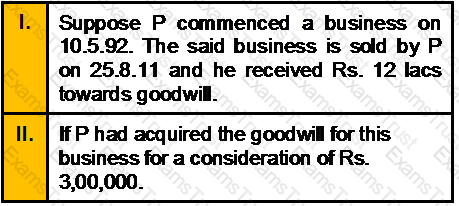

(CII for 1992-1993=223 and CII for 2011-2012 =785)

Calculate the LTCG in both cases?

Mr. Patel has analyzed a stock for a one-year holding period. The stock is currently quoting at Rs 80/- and is paying no dividends. There is a 50-50 chance that the stock may quote Rs 90 or Rs 110 by year-end. What is the expected return on the stock?

Mr Ram aged 53 years has put in 21 years of service in a PSU opts for a voluntary retirement under the company scheme. He has 5 years and 3 months of service left and his last drawn salary is Rs 18,000. He received Rs 10,00,000 as compensation. What would be the taxable part of this receipt?

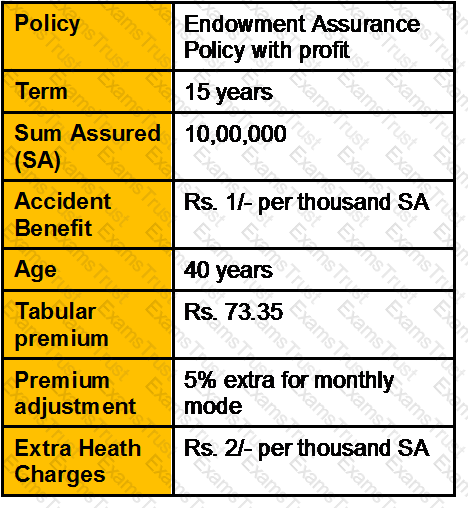

Given the following data, which one of the options will be monthly premium installment?

Rebate for large sum assured

Upto Rs. 24,999/- No rebate

From Rs. 25,000/- to 49,999/- @ Re 1 per thousand SA

From Rs. 50,000 and above @ Rs. 2 per thousand SA

Concept of final pay is a feature of

A money back policy for SA of Rs. 100000/-. Matured after 25 years. Survival benefits of 15% each has been paid at the end of 5th , 10th, 15th, and 20th years. Bonus has accrued at Rs. 965/- per Rs. 1000 SA. Interim bonus @ Rs. 25/- per thousand SA is payable. What is the maturity claim amount?

When cash flows occur at the beginning of each period, it is called as ___________

The beta of stock of Akhil Computers Ltd., is 1.5 and is currently in equilibrium. The required return on the stock is 19% and the expected return on the market is 15%. Suddenly due to a change in economic conditions, the expected return on the market increases to 17%. Other things remaining the same what would be new required rate of return on the stock?

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs. 1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the previous year 2010-11 and the rent has not changed since then.

Rahul and Priyanka went to a wealth manager. Both of them have just got married. Their funds are limited and their needs are many.

Some of their needs are:

Kindly suggest the order in which they should start providing for their above needs:

Which of the following are investment intermediaries?

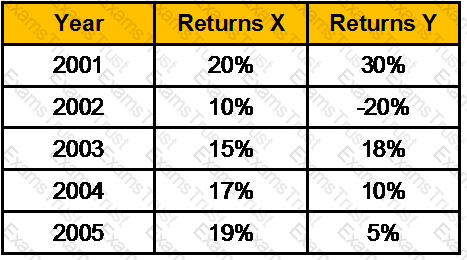

Case: The returns of 2 shares are as follows

Calculate the covariance of returns.

Ramesh has invested Rs. 70,000, 30% of which is invested in Company A, which has an expected rate of return of 15%, and 70% of which is invested in Company B, with an expected return of 12%. What is the expected percentage rate of return?

A Family consists of karta, his wife four sons and their wires and children and its income is Rs. 1000000 if by family arrangement income yield property is settled on karta his wife and sons & daughter in law than tax liability would be

An employee joined in the year 2000 in a sugar mill. After working all the years as a seasonal employee up to the year 2011. He retires with the following monthly salary Basic Salary 2000 / DA 1000/ HRA 500. How much gratuity is payable to him?

Mahesh has invested Rs. 72,000/- @ 5% p.a. in a bank deposit. After 7 years ROI changes 5% p.a. computed half yearly. After further period of 3 years rate again changes to 6% p.a. compounded quarterly. What will he get after 15 years of commencement?

As a CWM® you recommended Mr. Raj Malhotra to put his money in Asset A offering 15% annual return with a standard deviation of 10%, and balance funds in asset B offering a 9% annual return with a standard deviation of 8%. Assume the coefficient of correlation between the returns on assets A and B is 0.50. Calculate the expected return after 1 year and standard deviation of Mr. Raj Malhotra’s portfolio

Which one of the following statements is/are correct?

Saptarshi acquired shares of G Ltd. on 15.12.98 for Rs. 5 lacs which were sold on 14.6.11 for Rs. 19 lacs.

Expenses on transfer of shares Rs. 40,000. He invests ` 8 lacs in the bonds of Rural Electrification. Corporation Ltd. on 16.10.2011. Compute capital gain for the assessment year 2012-13.

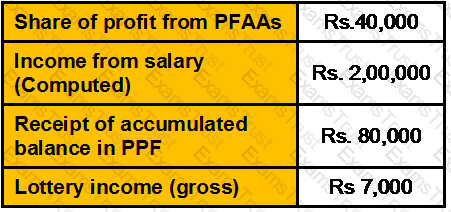

Sunil submits you the following particulars:

What is the minimum number of persons who must subscribe to the memorandum of association?

Economists group commercial banks, savings and loan associations, credit unions, mutual funds, mutual savings banks, insurance companies, pension funds, and finance companies together under the heading financial intermediaries. Financial intermediaries

A trust is created by a son, the Settlor, for the survival expenses of his retired parents each having equal beneficial interest. Both husband and wife have separate fixed pension of Rs.35,000 per month and Rs. 20,000 per month, respectively. The trust property has generated a net annual value of Rs. 5.12 lakh in the previous year 2012-13. The trustee as well as the Settlor is in the 30% tax bracket. Find the tax payable by the trustee as representative assessee.

Choose the amount of final tax liability of R for the assessment year 2007-08:

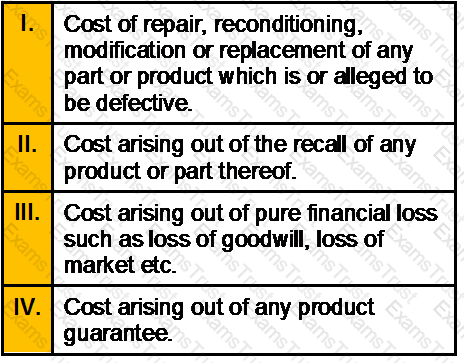

The coverage under a Product Liability policy includes:

Which of the above statements is/are correct?

Mr. Bharat sees a stock with a beta of 1.2 selling for Rs. 25 and price will move up to Rs. 31 by the end of the year. The risk free rate is 6% and the expected market return is 15 %. In this scenario Mr. Bharat would like to know whether the stock is _____________ and so should ___________.

Once the child reaches the vesting age, i.e. the age when the life assurance commences, he or she can claim cash option i.e. he can opt to receive the premium amount paid so far under the policy in case the policy is discontinued. This is possible under:

The holding period return on a stock was 30%. Its ending price was Rs.26 and its cash dividend was Rs.1.50. Its beginning price must have been __________.

Rishi wants to purchase a car 5 years from now. His investments are presently worth Rs. 48,000/-. He puts them into an account today at a ROI of 10% per annum and he would be contributing Rs. 5,000/- from end of this month, every month for 5 years. What would be his accumulated savings in this account after end of 5 years?

Which of the following is true with regard to wealth planner’s liability?

Mr.Tiwari is the sole income earner in the family. Mrs. Tiwari is a homemaker. They are aged 40 and 36 respectively. Life expectancy for both of them is another 40 years. They have no children. Other information you have is:

Current investment portfolio Rs. 20 lakh, Estimated final expenses – Rs. 1 lakh, present annual expenses- Rs 4 lakhs (including 1 lakh MrTiwari’s personal expenses), Mr. Tiwari’s post tax income in hand is Rs 3.5 lakhs. Assume a post tax; and post inflation rate, the discounting factor is 4%. Calculate the insurance requirement under the Needs Based Method.

Vishal is working with Amex Ltd since October 1, 1997. He is entitled to a basic salary of Rs. 6,000 pm.Dearness Allowance is 40% of Basic Salary for retirement benefits. He retired from his job on December 1,2010 (4 months before the end of F.Y 2010-11) and shifted to his village. He is entitled to the following benefits at the time of retirement. Gratuity = Rs. 98,000. Pension from December 1, 2008 = Rs. 2,000 per month. Payment from recognized PF = Rs. 3,00,000. Encashment of earned leave for 150 days = Rs. 36,000. He was entitled to 40 days leave for every completed year of service. He got 50% of his pension commuted in lump sum w.e.f March 1, 2011 and received Rs. 1,20,000 as commuted pension. Vishal contributes Rs. 900 per month to RPF to which his employer contributes an equal amount. What will be the amount of un-commuted pension for Vishal that will form part of his total income for the A.Y. 2011-12?

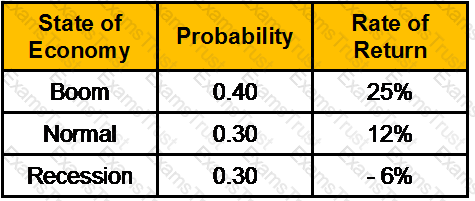

The probability distribution of the rate of return on ABC stock is given below:

What is the standard deviation of return?

"During the PY 2009-10 a Poonawala Charitable Trust earned an income of Rs. 7 lakh out of which Rs.5 lakh was received during the PY 2009-10 and the balance Rs. 2 lakh was received during the PY 2011-2012.In order to claim full exemption of Rs. 7 lakh in the PY 2009-10:

Asit an industrialist wants to buy a car presently costing Rs. 10,00,000/- after 5 years. The cost of the car is expected to increase by 10% pea for the first 3 years and by 6% in the remaining years. Asit wants to start a SIP with monthly contributions in HDFC Top 200 Mutual Fund. You as a CWM expect that the fund would give an average CAGR of 12% in the next 5 years. Please advise Asit the monthly SIP amount starting at the beginning of every month for the next 5 years to fulfill his goal of buying the Car he desires.

Case: Read the data given below & answer the following questions:

Market sensitive index will be:

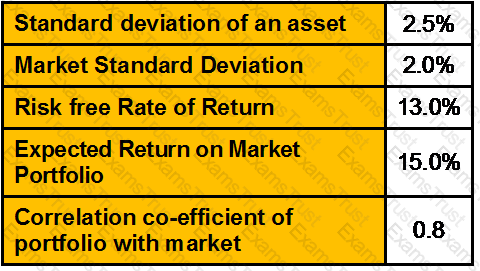

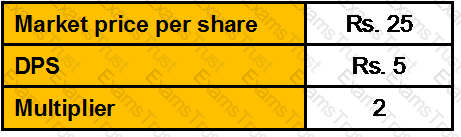

The following information regarding the equity shares of M/s V Ltd. is given

Calculate the EPS of M/s V Ltd. according to the traditional approach

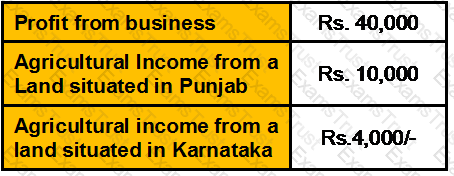

Compute Gross Total income and amount of loss allowed to be carried forward to next year:

If a scheme has 45 cr units issued and has a Face Value of Rs. 10 and NAV is at 11.13, unit capital (Rs. Cr) would be equal to

A stock caries the following returns over a five year period:

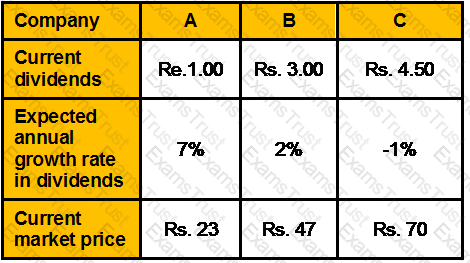

The information about 3 stocks is provided below:

Assuming that the required rate of return on investment is 14%, what maximum price an investor should be willing to pay and Which Stock should he buy?

Jaya is the owner of two residential houses. She sold one house on 23-12-2011 for Rs.12,50,000 which was purchased by her on 25-4-1979 for Rs.80,000. The market value of the land as on 1-4-1981 was Rs.98,000. Expenses on transfer were 1.5% of the sale price. The entire sale proceeds was utilized to construct the first and second floor on her second house which she completed by 15-3-2010. Compute the capital gain for the assessment year 2012-13. [CII-12-13: 852,11-12: 785, 10-11:711, 83-84: 116]

Michael estimates opportunity cost of investment to be 10.5% compounded annually. Which of the following is the best proposal?

Calculate the total return on the mutual fund investment with the below mentioned information:

Which of the following are the rights of the beneficiaries?

Azhar aged 30 is a disciplined investor. He has started depositing Rs. 25,000 every year in an account that pays a return of 9% every year. He plans to increase his contribution by Rs. 5000 every year till his age 50. Calculate the amount he would be having in his account at this age.?

Akash owns a piece of land situated in Kolkata ( Date of acquisition : March 1, 1983, Cost of acquisition Rs. 20,000/- value adopted by Stamp duty authority at the time of purchase Rs. 45,000/-) On March 30, 2012 the piece of land is transferred for 4 lakh. Find out the capital gains chargeable to tax if the value adopted by the Stamp duty authority is 5.75 lakh. And X files an appeal under the Stamp Act and Stamp duty valuation has been reduced to Rs. 4.90 lakh by the Kolkata High Cout. [CII-12-13: 852,11-12: 785,10-11:711]

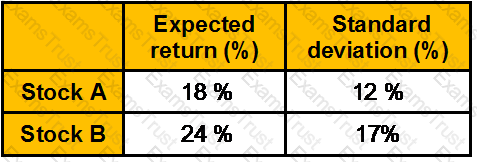

Consider two stocks, A and B

The returns on the stocks are perfectly negatively correlated.

What is the expected return of a portfolio comprising of stocks A and B when the portfolio is constructed to drive the standard deviation of portfolio return to zero?

Mr. Munjal has got her daughters son admitted to a dental college today, where he has to pay a fee of Rs. 1.5 Lac today i.e. at the time of admission. Then Rs. 1.75 lacs after 1 year, Rs. 2.5 lacs after 2 years and Rs. 3.25 lacs after 3 years. He wants to set aside the amount required today itself in the form of a Bank FDR.So how much he needs to put aside today if ROI is 8% for 1 year, 8.5% for 2 years and 9% for 3 years, all compounded Quarterly?

The current dividend on an equity share of MAGADH Limited is Rs.8.00 on earnings per share of Rs. 30.00. Assume that the growth rate of 20 percent will decline linearly over a five year period and then stabilize at 12 percent. What is the intrinsic value of MAGADH ’s share if the investors’ required rate of return is 15 percent?

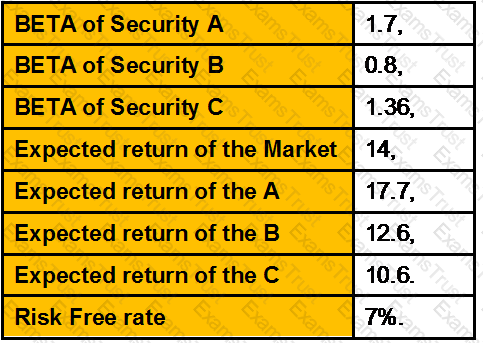

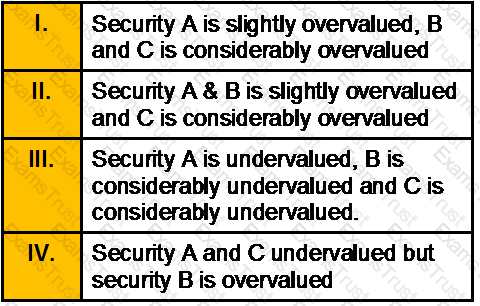

Consider the following information:

Which of the following statements is/are true?

Your client, a businessman has a house worth Rs. 2.1 crore and a farm house worth Rs. 85 lakh. His business is worth Rs. 10 crore as per last balance sheet. He has two other partners in the business having stakes of 24% each. He has two cars purchased at Rs. 40 lakh and Rs. 20 lakh, the latter being in personal account. The cars have depreciated/market value at Rs. 30 lakh and Rs. 8 lakh, respectively. His joint Demat account, wife being primary holder, has stocks worth Rs. 1.65 crore. The business has taken Keyman‟s insurance on his life of value Rs. 1.5 crore. He has himself insured his life for an assured sum of Rs. 1.5 crore. You evaluate your client’s estate in case of any exigency with his life as _____.

Ms. Sonali Briganza is 22 years old. She is currently earning a salary of Rs.5,00,000/- per annum and saves 20% of her salary every year. If her salary increases by 10% every year and she is able to get a return of 11% p.a. compounded annually throughout her investment horizon what would be the corpus of funds available at her age 58.?

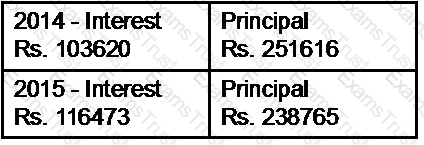

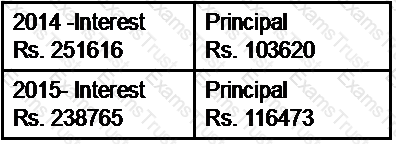

Dinesh took a housing loan of Rs. 25,00,000/- for 15 years in 2010 at a ROI of 11.75% per annum compounded monthly. Calculate the total interest and principle paid by him in the 2014 and 2016.

A)

B)

C)

D)

Puspinder Singh Ahluwalia took a housing loan on 1st. of June 2009 (EMI in arrear) of Rs. 50 lacs at a ROI of 10.75% p.a. compounded monthly for 12 years. He wants to know the deduction in taxable income he can claim u/s 24 of the IT act for the FY 2011 -12

The list of managing body needs for be fixed with Registrar of Joint Stock companies

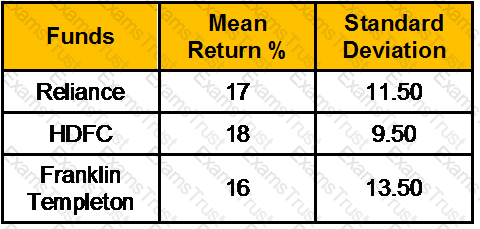

From the following data on mutual funds, Calculate the Sharpe Ratio.

Risk free return is 8%.

Rs. 1.50 lakh settled on a trust for the benefit of Akash and Bina for life. They share the income in proportion of 3:2.Their ages on valuation date are 20 years and 16 years. The average annual income for the last three years on the valuation date is Rs. 15,000/-. Find out the value of life interest of Akash and Bina if the value of life interest of Re 1/- at the age of 20 years is 12.273 and at the age of 16 years is 12.534.

Which of the following statements is/are correct?

R acquired a property by way of gift from his father in the previous year 1991-92 when its FMV was Rs. 3 lakh. The father had acquired the property in the previous year 1983-84 for Rs. 2 lakh. This property was introduced as capital contribution to a partnership firm in which R became a partner on 10/06/2011. The market value of the asset as on 10/06/2011 was 10 lakh, but it was recorded in the books of account of the firm at Rs. 8 lakh. Compute the capital gain chargeable in the hands of R.

Ramesh retired as General Manager of XYZ Co. Ltd. On 30.11.2012 after rendering service for 20 years and 10 months. He received Rs. 300000 as gratuity from the employer. (He is not covered by Gratuity Act, 1972).

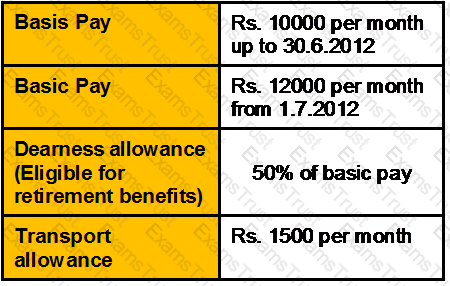

His salary particulars are given below:

He resides in his own house interest on monies borrowed for the self occupied house is Rs. 24000 for the year ended 31.03.2013

Compute taxable income of Ramesh for the year ended 31.03.2013.

Omar wants to make a gift of Rs. 10000 in today’s terms to his parents at the end of each of next 10 years. If the annual rate of return is 8% and inflation is 3%, what is the value of funds he must have in hand today to meet this need for the 10 year period?

What is the surrender value, if the sum assured is Rs. 100,000/-, DOC is 01/01/1997, endowment with profit 25 years, due date of last premium paid 01/01/2010. Premium to be paid semi-annually. Accrued bonus is 500 per thousand of SA. Surrender value factor is 19% ?

_______ is an Over the Counter market

NRE stands for

At the beginning of 2006 you have invested Rs 2000 in 40 Shares of ABC Ltd. During the year you received dividends @ 7 per share. At the end of 2006 you expect to sell share for Rs. 59. Compute return?

The principle of _____________ ensures that an insured does not profit by insuring with multiple insurers

Retiring early will need

Government has changed certain industries related regulation in Parliament, it is an example of:

Transfer of shares in the partnership firm is

A bond can be issued at premium if

Bond price is inversely related to yields

Within how many days prospectus or statement in lieu of prospectus should file with ROC

If any expenditure is incurred by an Indian company wholly and exclusively for the purpose of amalgamation or demerger, the said expenditure is

NSSO stands for ____________

As per Hindu succession Act 1956 following person is not considered as a class I heir of the person who dies intestate

Which of the following is not a key issue in retirement planning?

In Money laundering, a transaction involving cash used to buy high value goods,property or business assets is an example of which stage?

Which of the following is not correct in relation to ETFs?

Which of the following is true of mortgage?

"Which of the following can benefit from SARFAESI, 2002?"

The presence of _____ in financial markets leads to adverse selection and moral hazard problems that interfere with the efficient functioning of financial markets.

Mathematically the Efficient Frontier is the intersection of the Set of Portfolios with ....…. Variance and the Set of Portfolios with ……. Return.

If an assessed earns rent from a sub-tenant in respect to tenanted property let out as a residence, the said rent is:

Unabsorbed depreciation can be carried forward for ____________.

"Between the four items - Deposits; Borrowings; Reserves & Surplus; and Capital, which would appear last in the balance sheet of a bank?"

__________ records net change in ownership of foreign assets

BIS handles each of the following, except ________.

Which of the following can be a scheduled bank?

Which principle apply to life insurance contracts?

SHG stands for:

“Premium” is associated with

Often burdened with loan and generally both of the spouses work to earn their living. Under which category this type of family falls?

In a life insurance contract, offer refers to

The provision of fraudulent transfer is given in-

The Basel Committee has defined gross income as net interest income and plus net non-interest income and has allowed each relevant national supervisor to define gross income in accordance with the prevailing accounting practices. Accordingly the Reserve Bank of India in the draft guidelines issued on 11.03.2005 for implementation of the new capital adequacy framework has modified the Gross Income definition slightly. The Net Interest Income has been replaced by

Accumulation, preservation and distribution are stages of

Under flexible exchange rates a small open economy should

If there is an expectation of large decline in interest rates, which of the following investments should you choose?

The operatives Guidelines for Banks on Mobile Transactions in India were issued

In ULIP plans, the returns are dependent on in which the investments are done by the insurance company

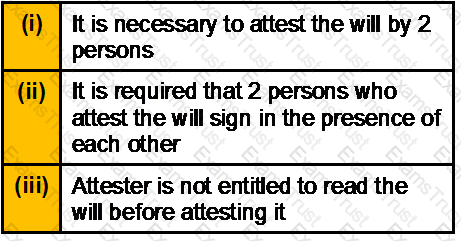

Your client Mr. Singhania expressed his intention to write his will in his own handwriting such a will which is wholly in the handwriting of the testator is renown as:

Which of the following statement is true?

What is the most essential characteristic to be in existence at the stage of establishing client relationship?

“Income rule” in Insurance advocates

A Foreign Bank is one

To take care of the risks during the foreign travel, Overseas Travel Insurance policy cover provides various other covers, in addition to __________ insurance, such as baggage cover, loss of transport cover, personal accident cover, personal legal liability cover etc.

Deduction under section 80C to 80U is allowed from:

Where a coparcener with only his widow as legal heir dies, Can a partition be deemed as between the surviving coparcener and the widow on his death?

Inflation refers to ............

One should accept a project if NPV is

Onshore wealth management involves ____________

A review of portfolio should be done when

All the following statements concerning unsystematic risk are correct EXCEPT:

Which of the following is not true in respect of the conditions essential for taxing income under the head income from House Property?

Financial goals must be SMART. SMART stands for _________________

Which of the following statements in reference to REPO Rate is/are correct?

In case of self occupied property, higher deduction u/s24(b) for interest on loan for construction can be claimed if borrowing was made

According to the Gordon model, the discount rate used by the investors exhibits what type of relationship with the retention rate?

In case of public company memo must be signed by atleast ….… persons.

A security's beta coefficient will be negative if _____________.

EBT stands for

Which one of the following Sections of the Transfer of Property Act defines “Transfer of Property”?

The length of the insurance industry’s business cycle is shortened because of

For claiming exemption u/s 54G, the assessed shall acquire the new asset within: